The End is Near (kinda)

A Breakthrough Discovery in the Research of the Causes of Cyclicity - Wealth Cycle II

When I was concluding the first part of American Cycle, I mentioned that this wasn't the end of research into the remarkable cyclicity of the American economy. Despite the many answers we managed to obtain—as is often the case—much remained to be done.

The most important questions to me were:

can we surpass the scientific consensus (subjective) in defining the time boundaries of the cycle and formulate a more objective method derived directly from data?

why does this continuous alternation between "easy and hard" times in the economy and the market occur or what is the substantive reason behind the regular exchange of positive sentiment with negative?

additionally, a pertinent question arose: can we somehow quantify the varying durations of the cycle in mathematical manner?

I am extremely pleased to inform you that I have largely succeeded in obtaining answers to the above questions. These answers open additional doors to understanding the nature of cyclicality that I presented in the first part of American Cycle.

However, I did not expect that the cause prompting the transition from the growth phase to the decline phase has such profound significance. First, the picture of reality now becomes much clearer, but perhaps more importantly, it turns out that the alternation may not necessarily last indefinitely. The cycle can break down in the sense that in the next phase we might not receive the opposite direction; it may happen that the decline phase (or growth phase) continues further! And most importantly, we now know why and when this can occur.

The second part of Wealth Cycle will be published this October. If the first part opened your eyes to certain aspects of reality, you will see how the second part completes the picture.

Remember that to gain access to the second part, you must first have access to the first part. The second part simply won't make sense without the first. If you already have the first part, log in to emini.today, go to the Wealth Cycle package, where you'll find further instructions. If you don't yet have access to the first part, you can still purchase it on my website under the "Subscribe" tab.

Three Years Until S**t Hits the Fan.

What Can You Do About It, How to Prepare?

Whatever may happen in the upcoming new phase of the cycle, nothing will change the fact that the times just around the corner will be tough. Whether these tough times will extend into another phase, we don't know yet, but the immediate future of the next dozen or so years appears bleak. The years 2027-28 will bring the beginning of serious economic turmoil across the globe. At this point, it's difficult to predict how deep the dynamics of the recession will be, but there's no doubt that those who aren't prepared for what's to come will face serious problems.

Of course, even the most difficult times—and often it is precisely those times—become life-changing opportunities. The catch is that to take advantage of these opportunities, one must first have the financial means, security in the form of wealth accumulated during times of prosperity. Therefore, especially for existing users of emini.today, I am introducing a new segment in which I will strive to help make the most of the upcoming three years.

The goal is this: maximizing profits with short-term strategies. Let's not kid ourselves; if you haven't managed to accumulate adequate financial security up to now, then in the classic investment-savings scheme, three years is probably not gonna cut it. Ofcourse, there are no guarantees; after all, it's the market, not a 9-5 job. However, with a bit of luck and perseverance, you might succeed in multiplying a small amount of capital to a safe level.

First time ever on Emini.Today - Trading Options with Short-Term Strategies.

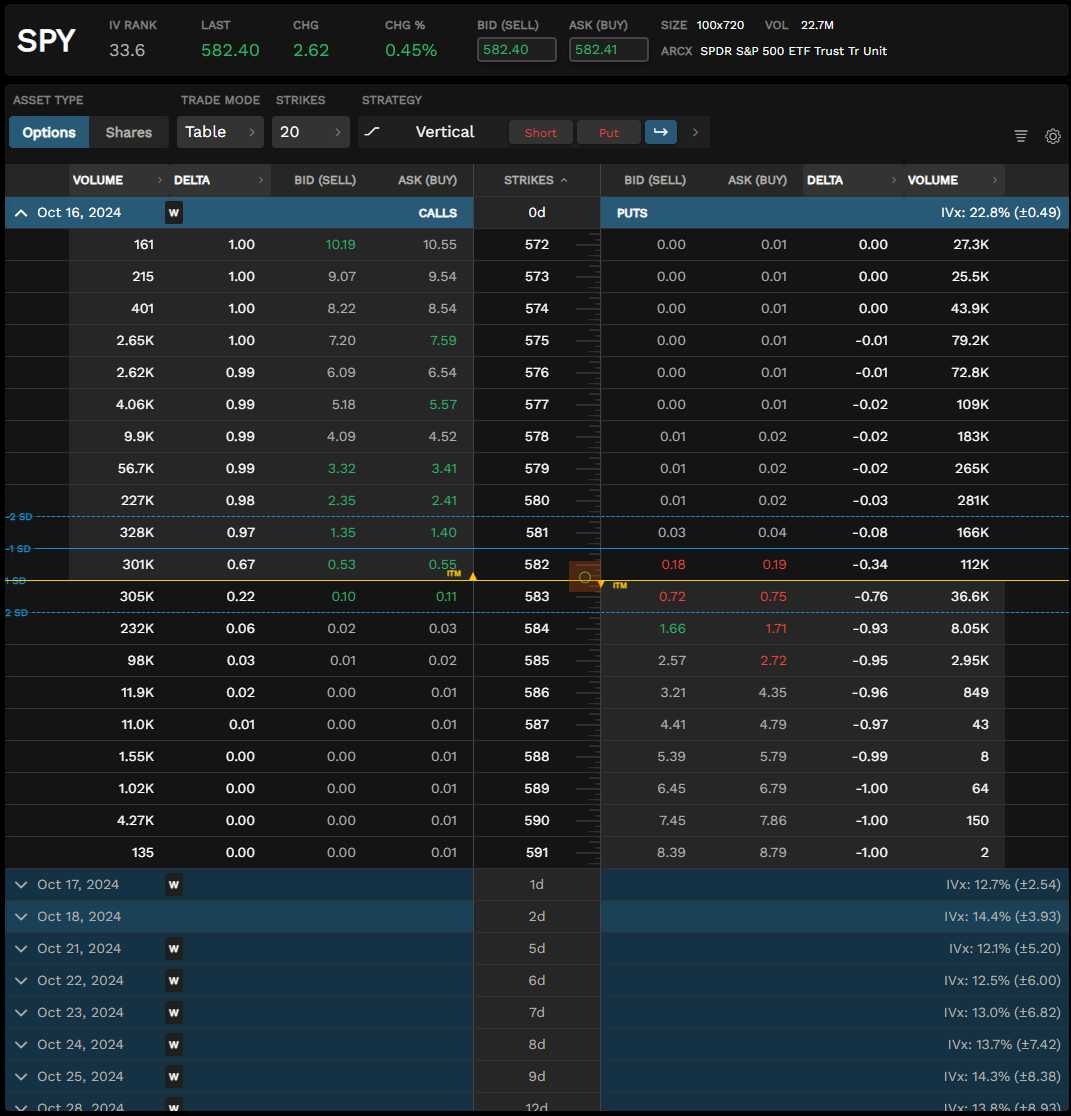

We will start with what currently works best in the arsenal of emini.today. However, we will primarily use options as our trading vehicle. It won't be the simplest buying of calls or puts; we'll define risk a bit differently but nothing too fancy. We want to keep our trading within simple rules.

Ofcourse, these strategies can also be applied in the futures market, but I believe that options, in particular, can help many people reverse certain bad habits that so often lead to failure. It's not the strategy or analysis itself, but rather the poor handling of both losses and gains. As a result, we reduce the uncertainty of when to close a position and also prevent the accumulation of losses.

Look, I know that people are sensitive to this type of doom and gloom content—the end of the world, a great crisis is coming, and so on. But if you've followed my publications even a little, you know that I've been very bullish in the long term for a long time, while at the same time clearly stating how much time is left, in my opinion, until a secular bear market occurs. I don't know and don't understand why more people don't see these basic and simple “patterns” that have been repeating for over 120 years—over and over again.

Could it be different this time? Probably, but I highly doubt it because all the data says otherwise—in other words, the probability is on my side, and after all, this is a game of probabilities. On the other hand, even if the great crisis somehow doesn't come and civilization slips unharmed into the next bright era, I think you still lose nothing and gain—knowledge and skills.