Overnight Options Metrics:

Dealers: bullish

Sentiment: bullish

Structure: bullish

(See notes below for the explanation)

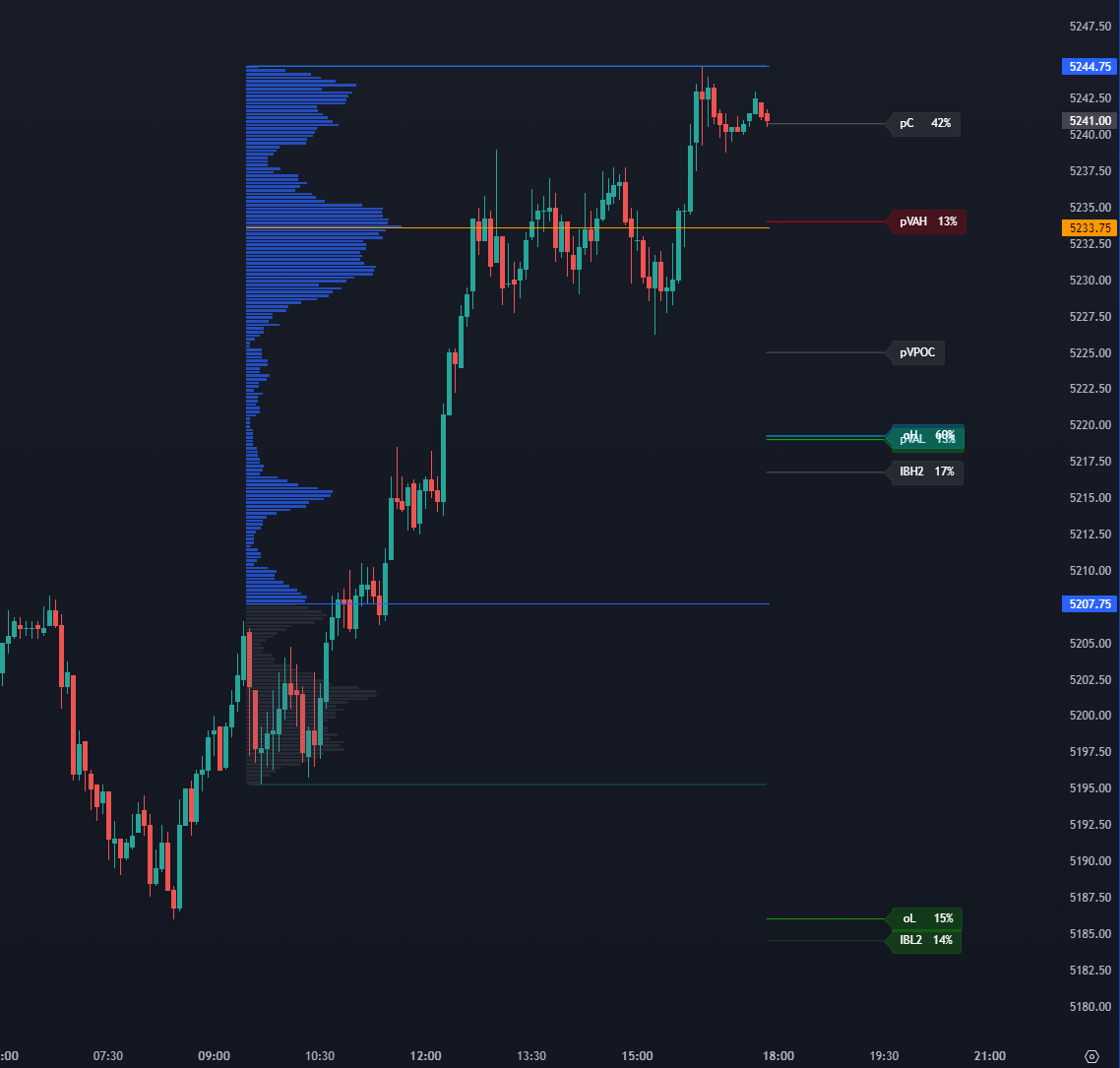

Structure Levels:

Dealers Levels and Stats:

(updated for the review after RTH close)

Probability Map:

Notes:

After the RTH (Regular Trading Hours) session closes, we can draw three distinct conclusions based on recent options activity:

Dealers (bullish/bearish) - 80% of time following price, pay attention when it diverges from RTH price action. For example if market closes higher than it opened but Dealers are Bearish. This stat is based on SPX options orderflow during RTH session.

Sentiment (bullish/bearish/neutral) - marginal skew to the upside, usually first sign of market weakness in an uptrend (Sentiment: Bearish) or market strength in a downtrend (Sentiment: Bullish). Based on large SPX options transaction analysis.

Structure (bullish/bearish/neutral) - typical overnight drift based on overnight options profile.

To obtain a complete picture of the current situation, it is necessary to include morning metrics (after the opening of the European market) in the London GEX posts.

All the above analysis is made with “Options Ladder + GEX (ES)” tool which you can find in emini.today web terminal or Sierrachart/Ninjatrader Options Study Pack.