Key takeways:

Today we have a shortened session and options market is closed so no in-depth analysis as we are missing key data. But because it’s a start of new month I will go through some important things in this commentary.

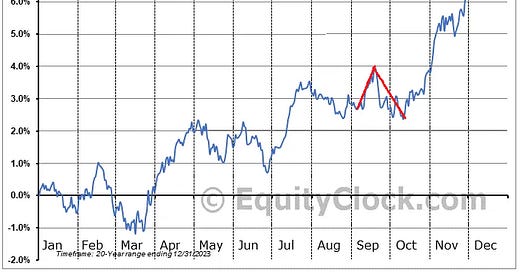

First of all, seasonality in september is perceived as rather negative. Especially the second part of it until about half of october.

VIX term structure seems to confirm this seasonality bias:

Second thing is that a lot of people is pointing to something quite alarming regarding unemployment which turned up recently. This often indicated beginning of recessions in the past as you can see on a chart below (recessions marked with grey areas).

It’s definietly something I will have in mind especially at next jobs report. But also I would like to point out that there were times when these spikes did not lead to recession, so it is not some kind of definitive signal.

Personally I already closed some of midterm long (I wrote about 1/4 of position) last week when profile turned bearish. But, until midterm TrendPhase shows bearish signal I still hold on to bullish side.

Options structure based on friday close:

Intraday sup/res for today:

Resistance: 5704

Support: 5634-28

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).