//Midterm Sentiment//

(days)

TrendPhase: Bullish (Sep 17)

Orderflow: Bearish (Oct 24)

------------------------------

(weeks)

Positioning: Neutral/Bearish (Sep 27)

Dealers: Bullish (Oct 21)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

VIX: Bullish (Sep 18)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral

------------------------------

//Actionable Levels//

Resistance: 5865-5875

Support: 5793-89Key takeways:

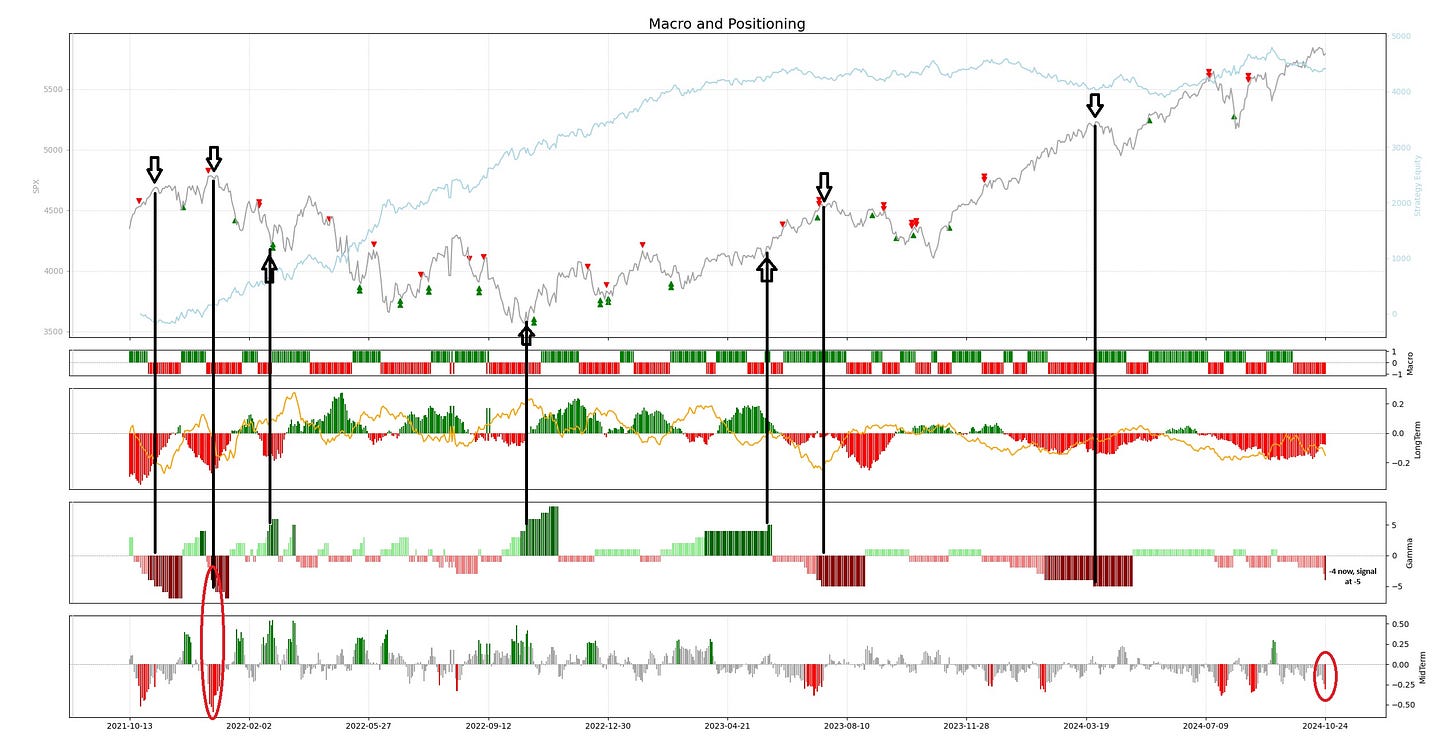

Long time no see, Gamma is -4 which is just one tick from -5; and that would be strong bearish signal in Positioning (right now neutral/bearish).

Also, one can notice midterm positioning printing red.

This is going to be tricky, next month or so as we are aproaching massively bullish seasonal period. Just look at this performance of buying at the end of october and holding until beginning of december…

So on one hand potential strong sell signal is setting up (again, it’s not triggered yet) and on the other the most bullish season period in a year.

Personally i’m still in neutral swing position, waiting maybe for trendphase to join with orderflow. I also consider options trade with this seasonal bullish pattern, buying maybe vertical bullish spread with Dec 6 expiration…

Yesterday’s Intraday Trading Recap:

Bearish flow trying to break on positive side before RTH and then almost lower band on orderbook. Again not the strongest setups.

On futures/internals nothing clean in sense of confluence, lacking absorption at bottom and footprint confirmation on second trade but worth the risk (1/2 size) in both cases.

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).