//Midterm Sentiment//

(days)

TrendPhase: Bullish (Sep 17)

Orderflow: Bearish (Oct 24)

------------------------------

(weeks)

Positioning: Neutral/Bearish (Sep 27)

Dealers: Bullish (Oct 21)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

VIX: Bullish (Sep 18)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral

------------------------------

//Actionable Levels//

Resistance: 5875

Support: 5789Key takeways:

Orderflow bearish signal. Closing my midterm long position. I am considering initiating small short but might wait for intraday confirmation. Not sure yet.

Yesterday’s Intraday Trading Recap:

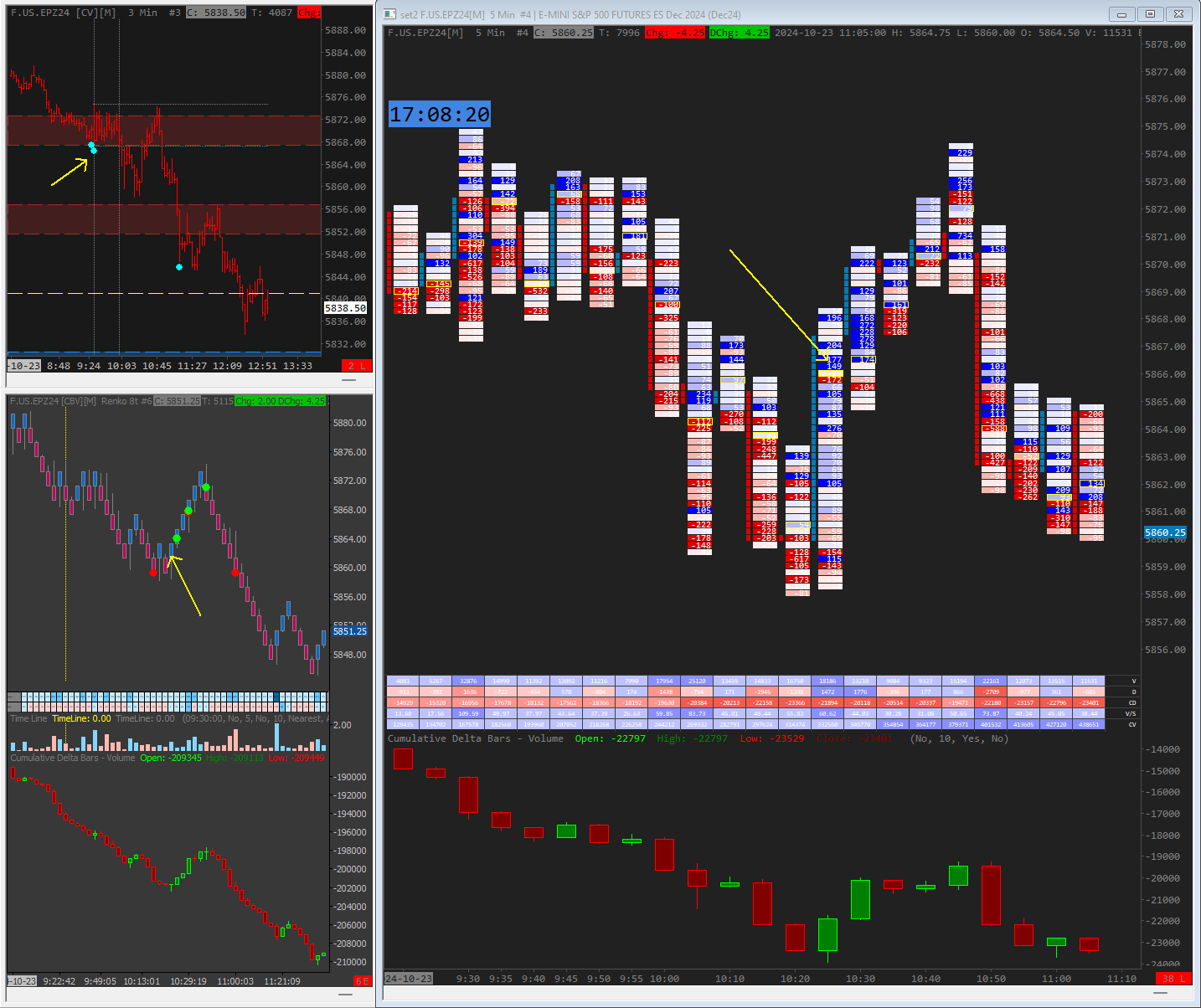

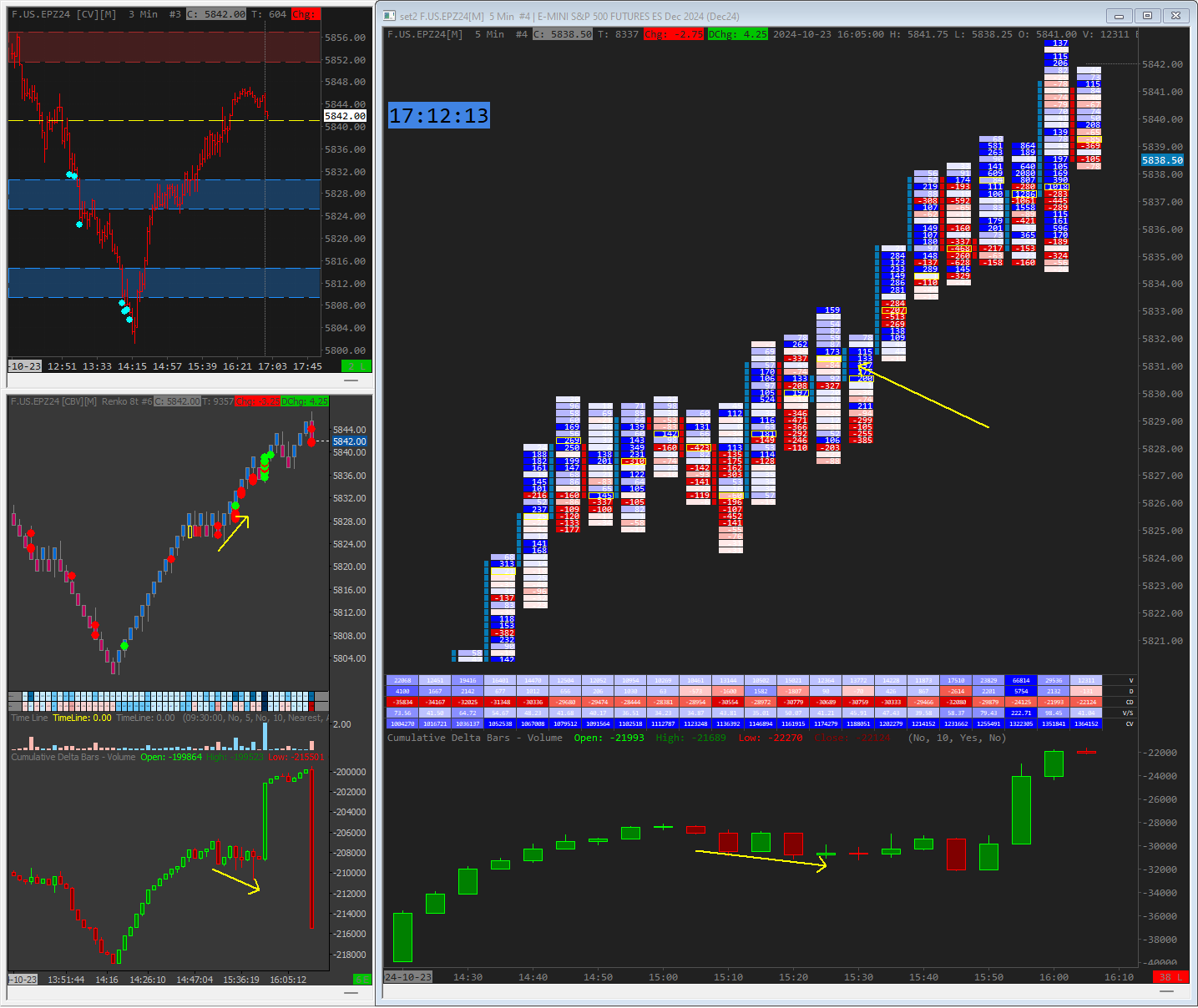

Option tools provided only small supportive flows during decline. 5-10 point scalps at best. These were not the perfect setups though. More on that in “Trading Options” package.

On futures/internals front just one clean setup (visible absorption) at the first part of session and the second one was hour before close.

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).