//Midterm Sentiment//

(days)

TrendPhase: Neutral/Bearish (Nov 6 / Oct 30)

Orderflow: Neutral (Nov 6)

------------------------------

(weeks)

Positioning: Neutral/Bearish (Sep 27)

Dealers: Neutral (Oct 30)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

VIX: Bullish (Sep 18)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral/Bearish

------------------------------

//Actionable Levels//

Resistance: 5987, 6000

Support:Key takeways:

Ok, this is going to be interesting. I would call today as a red alert day. We have a lot going on in options metrics which show long time no see bearish indications + FOMC meeting in the evening.

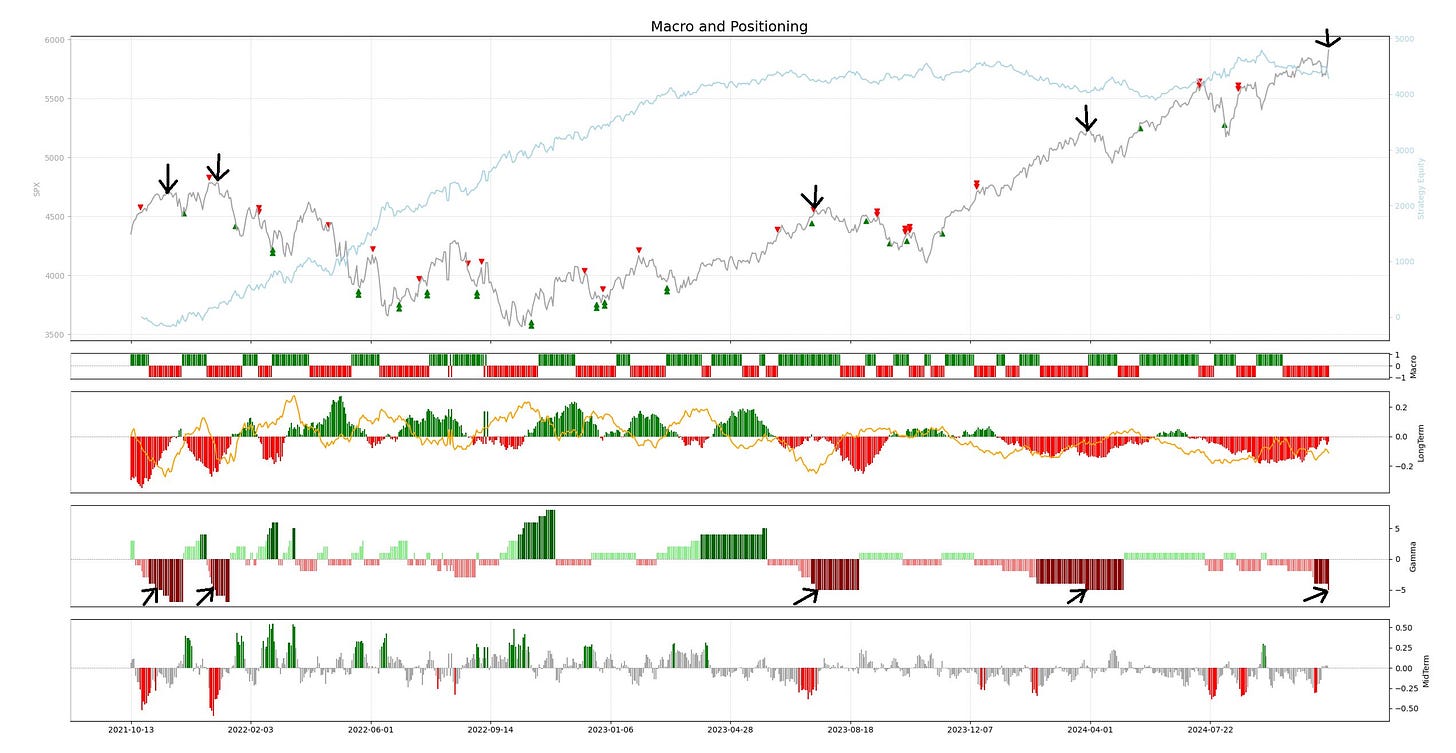

First thing is Gamma -5 in midterm positioning dashboard. Below are all the historical signals. As you can see it’s hard to ignore this one. But, one should remember this signal is a swing signal. It usually takes (on average) like 5 days for the market to start decline harder, but during that time it doesn’t go higher either. The trade on average takes about 25 calendar days until profits can be harvested. As you can see, it begs for some kind of options play, no?

But, that’s not all. On intraday trendphase we have sr1/sr2 moved above zero gamma, which is neutral/bearish signal and under some conditions it can turn out as bullish signal tomorrow - but let’s not get ahead. Today it is neutral/bearish.

Third thing is look at the spread between sr1 and sr2. Over 30 points, this is also bearish.

Having said all that. One have to remember that these signals are a product of what happened during election night and the huge rally which came afterward. So it’s no surprise that we have overbought signals all over the place. Now, we can assume that the fuel to this rally is not yet burnt out, you know, lots of fomo etc. and that by itself screws and skews metrics which is going to lead to a trap for bears - look at the longterm cycle, look at the seasonality where November is the strongest month!

Well, you can not ignore such thinking. And I am defienietly not 100% sure about anything here. So the question is, how to trade that short - if one decides to do it?

Personally I will look for some vertical spread 25-30 days out 20-30 delta probably, just because historically the signal was very strong.

Intraday today, I will defienietly look for some short opportunity but I won’t bet a house on that. Something like 1/4 maybe 1/2 of normal position. And most of all, don’t get trapped. Use options if you can. Define risk, risk which you can take.

Yesterday’s Intraday Trading Recap:

Yesterday was the same situation as day before. Huge absorption of sellers. This time its a bit different though as we can see capitulation in latter part of session. Also, two days in a row of such absorption… tsk tsk. It’s not bullish so much now imo.

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).