//Midterm Sentiment//

(days)

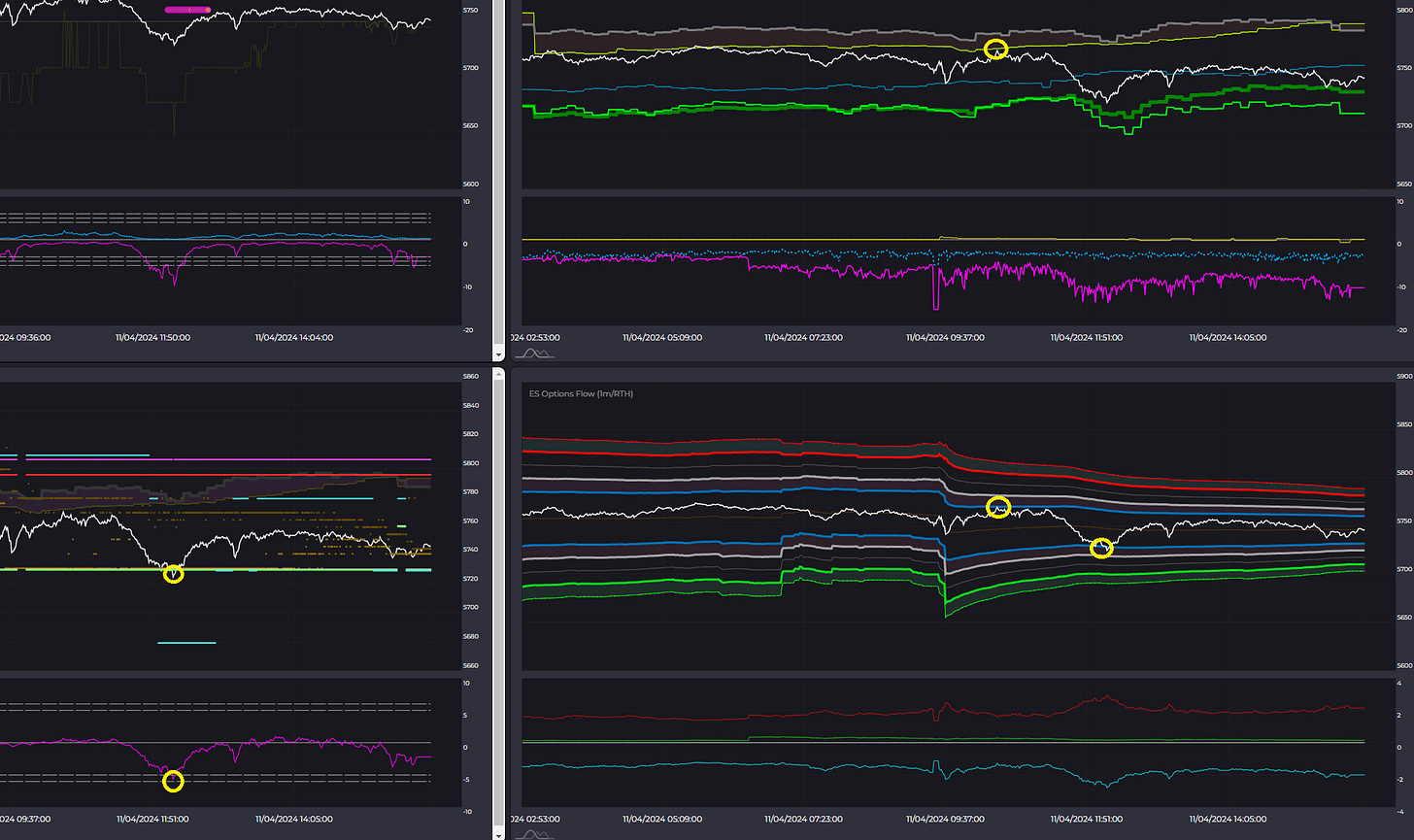

TrendPhase: Bearish (Oct 30)

Orderflow: Bearish (Nov 1)

------------------------------

(weeks)

Positioning: Neutral/Bearish (Sep 27)

Dealers: Neutral (Oct 30)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

VIX: Bullish (Sep 18)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Bearish

------------------------------

//Actionable Levels//

Resistance: 5810-5822

Support:Key takeways:

Election day is here and major metrics seem to be bearish (midterm and intraday).

I tried to pick up some patterns from recent election days but to be honest it looks too weak for me to formulate any trading ideas based on that.

So, scaling into some shorts intraday, midterm small short positions are still on and im not going to reduce/close them for the election.

One thing which makes me not wanting to go full size short intraday is of course the anchored vwap which works so precise during longterm bullish cycles. We have bounced from Sep 6 low vwap calculated with lows, which also corresponds with Aug 5 calculated with highs.

Yesterday’s Intraday Trading Recap:

Almost perfect situation on options yesterday - almost because wasn’t confirmed by indicators, but price wise it was a great trade from top to bottom of the swing which I showed and described in Trading Options channel yesterday.

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).