Recap of yesterday’s HPI and other options + orderflow metrics.

Key Orderflow and Options Levels (ES Futures):

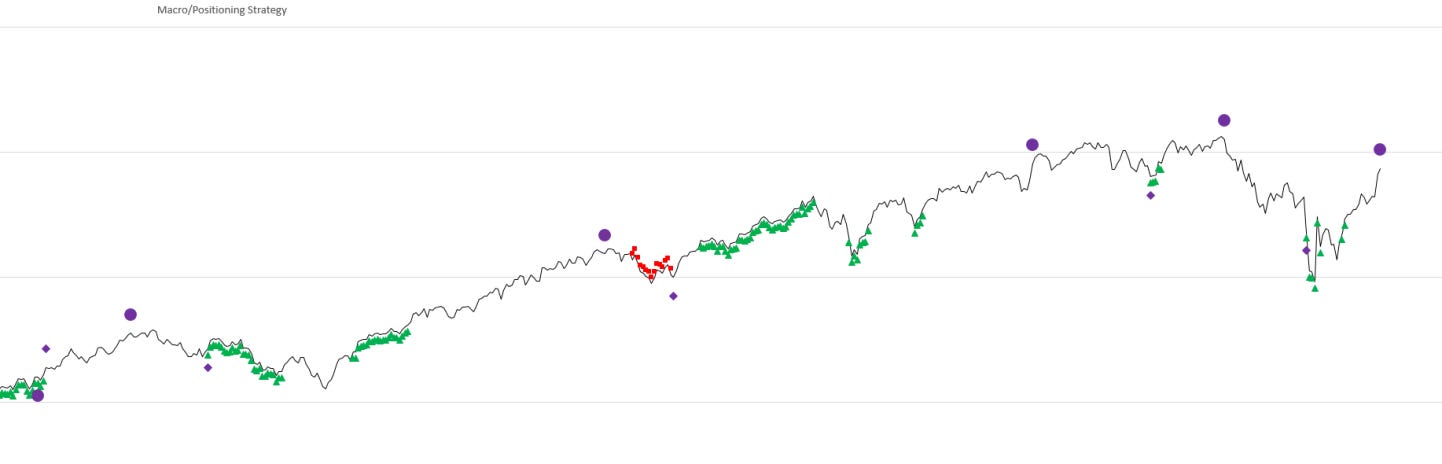

TrendPhase (SPX):

There are three types of signals on this chart, represented by small circles. Circles below price are bullish signals, above price are bearish signals.

Midterm Cumulative:

//Midterm Metrics//

Macro/Positioning: Neutral/Short

OptionsTrendPhase: Long

Auction/Orderflow: Neutral/ShortKey takeways:

Options key resistance: -

Options key support: -

Orderflow critical area: 5906

Still no change in midterm metrics.

Option levels are a mess today so not going to rely on them. Orderflow 5906 seems interesting pivotal point.

…this is big.

My intraday orderflow studies (first three) are ready to deploy. You will finally be able to get my intraday orderflow confirmations, which I talk about here, on your sierrachart. It took a while to automate them but now it will be so much easier to monitor auction.

It was impossible to post these as live signals and it was always kind of hard to explain in all details how do I filter levels, what do I look at tape, dom etc. Hopefuly this will help a lot.

First testing phase for limited number of users will start later today on emini.today.