Key takeways:

Zero on signal metric - means don’t trade today (that’s what it says in my notes ;) ).

“Tripple witching” also, adds to spooky session.

Whatever I will do, it is going to be with 1/4 of my regular size.

There are still more bullish arguments (from intraday pov) than bearish.

Swing/Midterm perspective unchanged (bullish).

Not going to rush trades today, which means I will look for confirmations like absorptions.

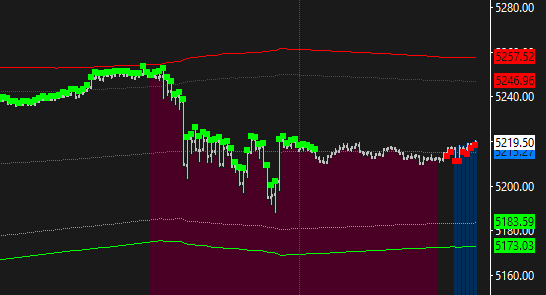

Problematic levels for bulls are 5253-58 area. For bears 5178-73.

But… as to levels, these are not so important for me today. Like I wrote above, I want to see something constructive from bulls, live, on “tape”, to convince me to trade today.

Notes/Observations/Issues:

Yesterday was rather bad in sense of my analysis itself. I ignored bearish sentiment and bearish flip of dealers during eth (rare). “Miraculously” used to re-enter on hard bottom levels from GEX and it paid (it usually does). But that doesn’t change the fact that I made a terrible mistake.

Orderflow started to print bullish signal today (if we assume this contract series is another one with inverted correlation [red→bullish, green→bearish).

GEX levels are a mess, normal thing on opex days. One more argument to let that day go.

Crypto is on the move (down) again, so another attempt to fulfill “before halving” pullback. Bearish area high almost got hit. We’ll see. For me the real opportunity will come after halving, exactly when and at what price is to be established. Question is, what about correlation with equities (in case of pullback on crypto)?

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).