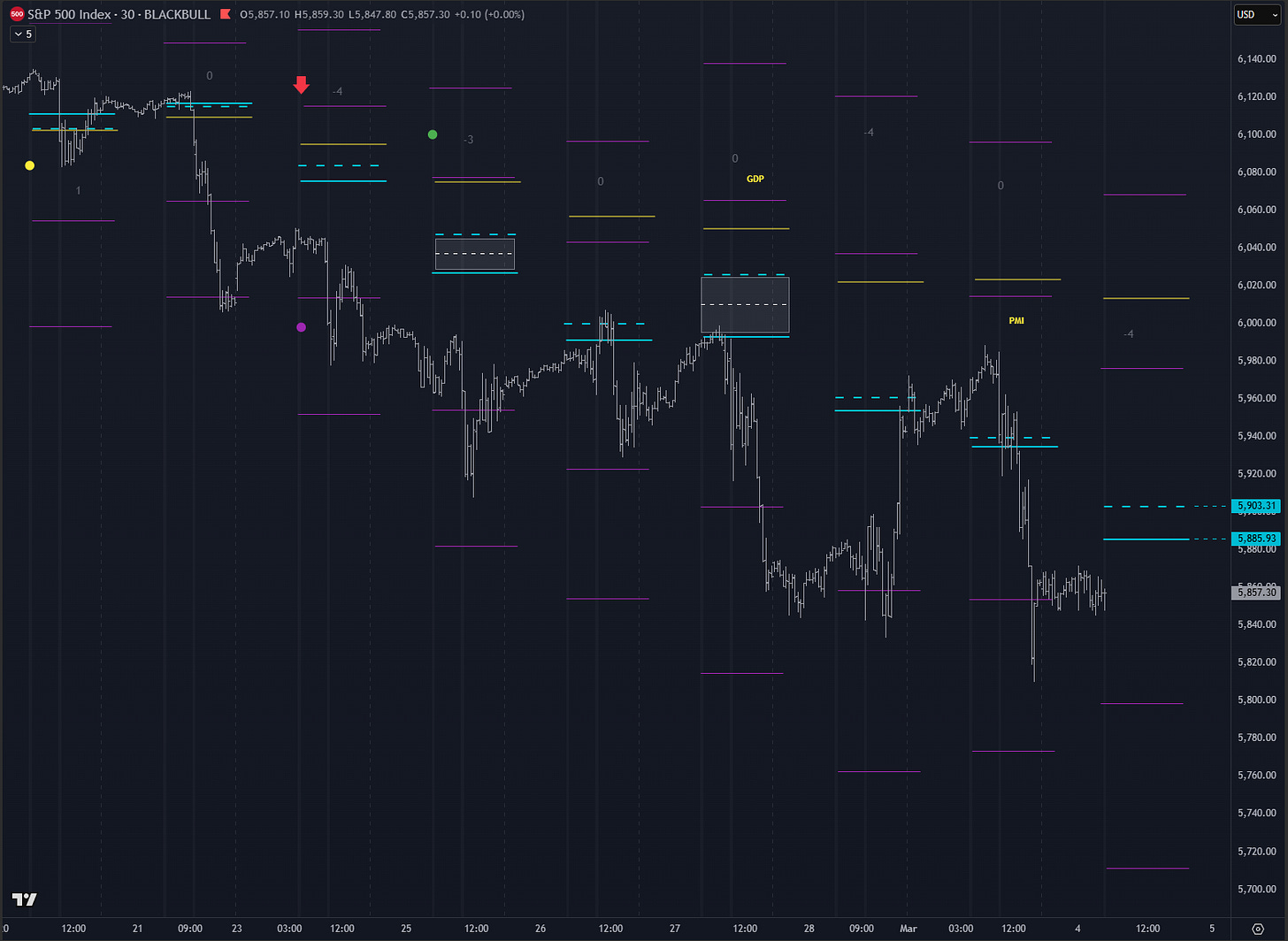

Structure + Gamma Levels:

Key Options Levels:

SPX TrendPhase:

Midterm Cumulative:

//Actionable Levels//

Resistance: 6025-35

Pivot: 5923

Support: 5780-70Key takeways:

Macro/Positioning changed yesterday after PMI number. Fast model is bearish now, slow is still bullish.

Hedge Pressure Index is quite compressed since yesterday. It means options market might have a bit less impact than last few weeks.

I will probably use same tactic as yesterday, wait for the price to get back to pivot or actionable sup/res areas and trade from there. Otherwise let bots trade.

Notes:

Yesterday’s HPI signals and other option metrics.

We entered new month and new bots with a bang. 140 points trade on HPI(a) bot. Right now 2 bots are being tested on real accounts. The other two are still in the making.