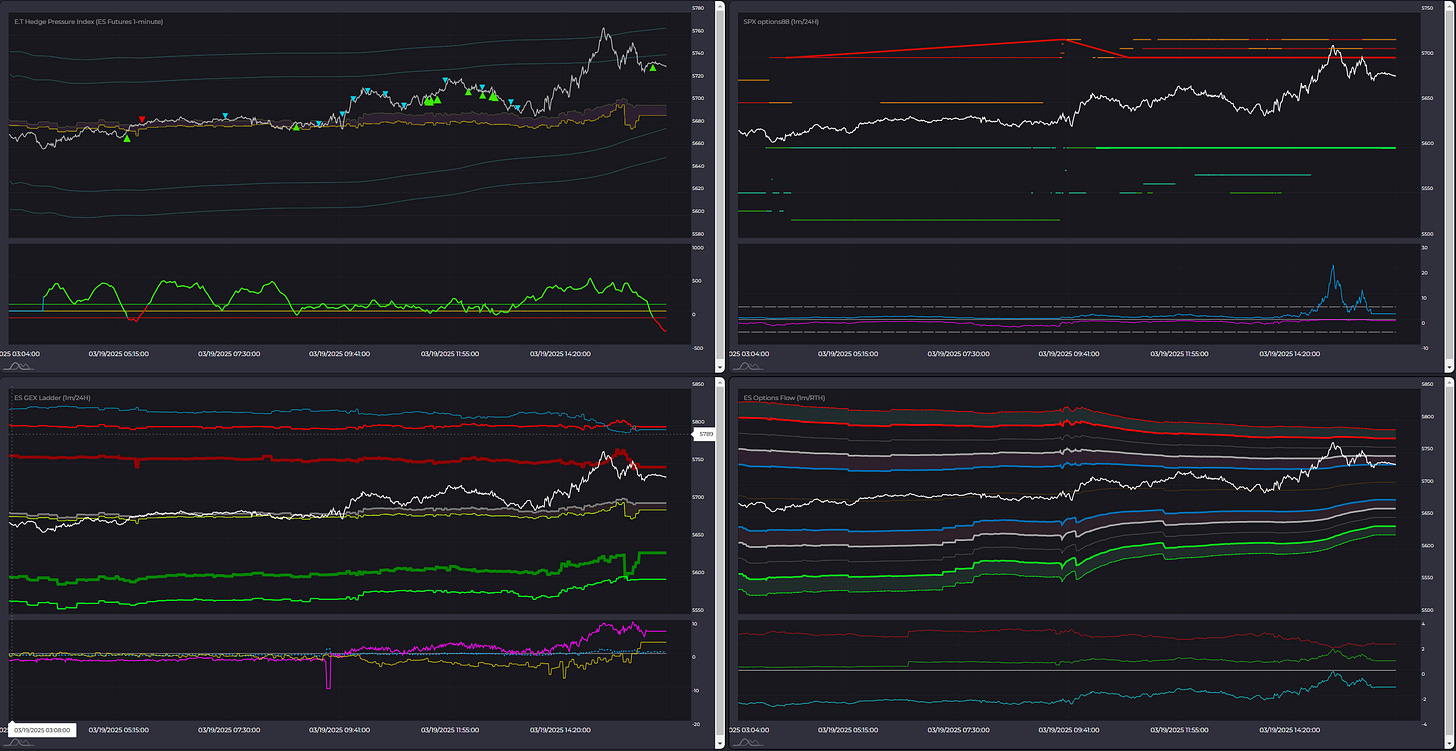

Key Orderflow and Options Levels (ES Futures - June contract):

Options Levels (middle and right chart) show significant option prices for the session. Best practice is to look for confluence between levels on center and right chart. These levels should be +/- 5 points max away from each other.

TrendPhase (SPX):

There are three types of signals on this chart, represented by small circles. Circles below price are bullish signals, above price are bearish signals.

Midterm Cumulative:

This section is undergoing some redo and simplification.

//Midterm Metrics//

Macro/Positioning: 0

OptionsTrendPhase: 1

Auction/Orderflow: -1

Alerts: 1

Key takeways:

Confluence on options levels at: 5789-91, 5827-29, 5555

OPEX is in full swing now so size down on options analysis tools is advisable.

Notes:

Recap of yesterday’s HPI and other options metrics + Orderflow Structure.

Yesterday’s orderflow and options structure.

We traded pivot break sequence live yesterday on discord which worked very nicely as usual. If you want to learn how it was handled, please go to general channel and read yesterday’s conversation where I talked through this trade step by step while it was developing.