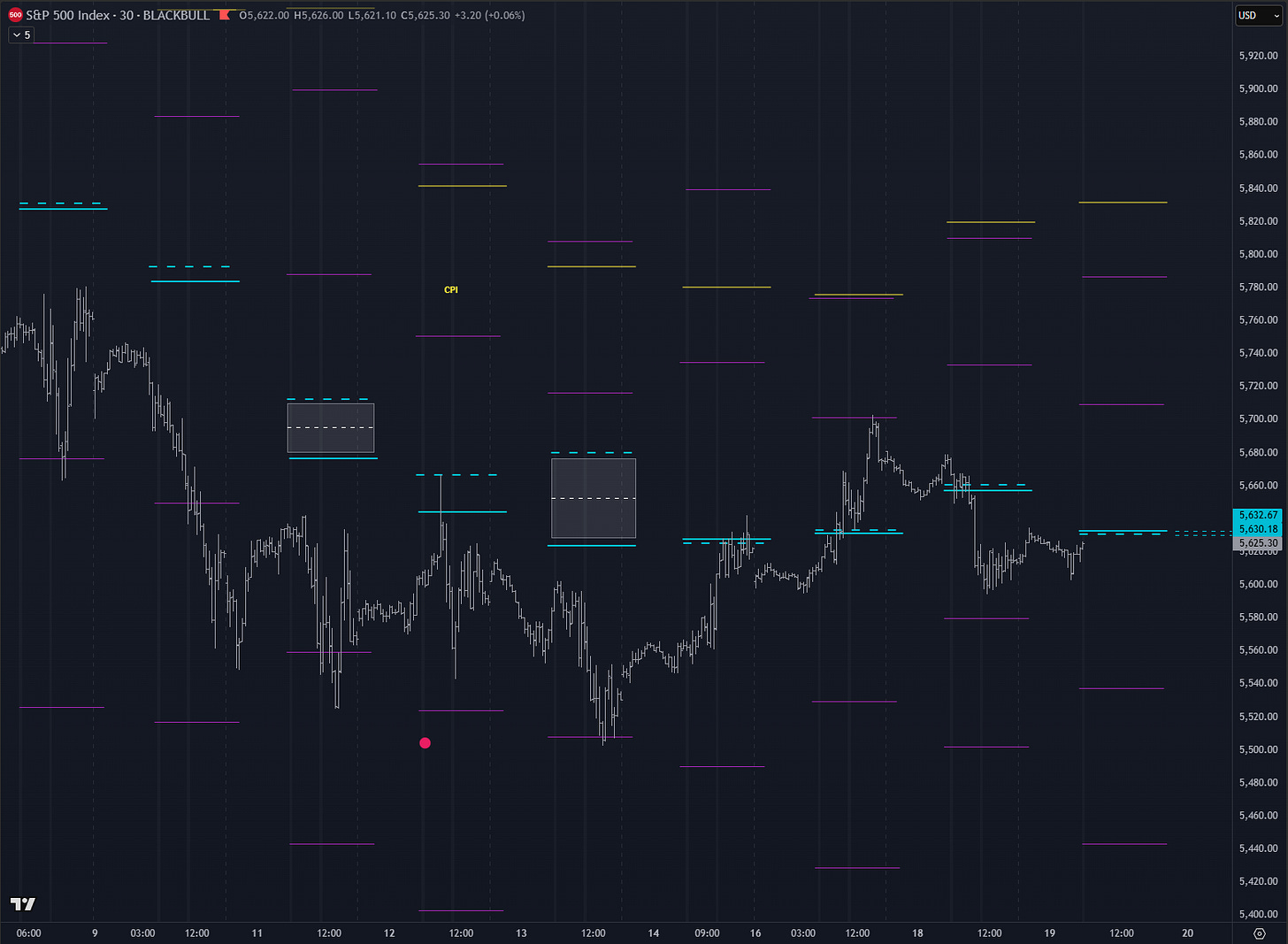

Key Orderflow and Options Levels (ES Futures - June contract):

Options Levels (middle and right chart) show significant option prices for the session. Best practice is to look for confluence between levels on center and right chart. These levels should be +/- 5 points max away from each other.

TrendPhase (SPX):

There are three types of signals on this chart, represented by small circles. Circles below price are bullish signals, above price are bearish signals.

Midterm Cumulative:

This section is undergoing some redo and simplification.

//Midterm Metrics//

Macro/Positioning: 0

OptionsTrendPhase: 1

Auction/Orderflow: -1

Alerts: 1

Key takeways:

FOMC today and one can already see market awaits decission.

Nothing changed on midterm front, macro/positioning strategy is still in neutral/negative territory, orderflow/auction is still negative, and options trendphase is the one which indicates bullish stance.

Intraday I dont see much confluence on options static levels posted above so I think I will wait for price to aproach pivot and look for intraday action there.

Notes:

Recap of yesterday’s HPI and other options metrics + Orderflow Structure.

Again, best signal occured at the bottom yesterday (green arrow inside lower hpi price bands which I circled with yellow color on screenshot below). This is how HPI( c) bot operates and I think at the moment this one is the most reliable one.

It seems to me that there is much more to HPI than I originally thought. Dealers impact on the market is quite complex thing and defined by many different factors which are always just an estimation - we are limited with the data, even the best data available, its still limited. But I can see more and more detailed structure of mechanism and I will be implementing it into simple to use form - as I always try to do. So keep watching this space as its getting really interesting.

Yesterday’s orderflow and options structure.

Once price went back into previous range we had just one opportunity (retest of range level) to get that short and price dived.

“Intraday I dont see much confluence on options static levels posted above so I think I will wait for price to aproach pivot and look for intraday action there.”

So how you treat that pivot? As support or resistance to catch few points? You assume it will always react when price approaches it for 1st time given day?