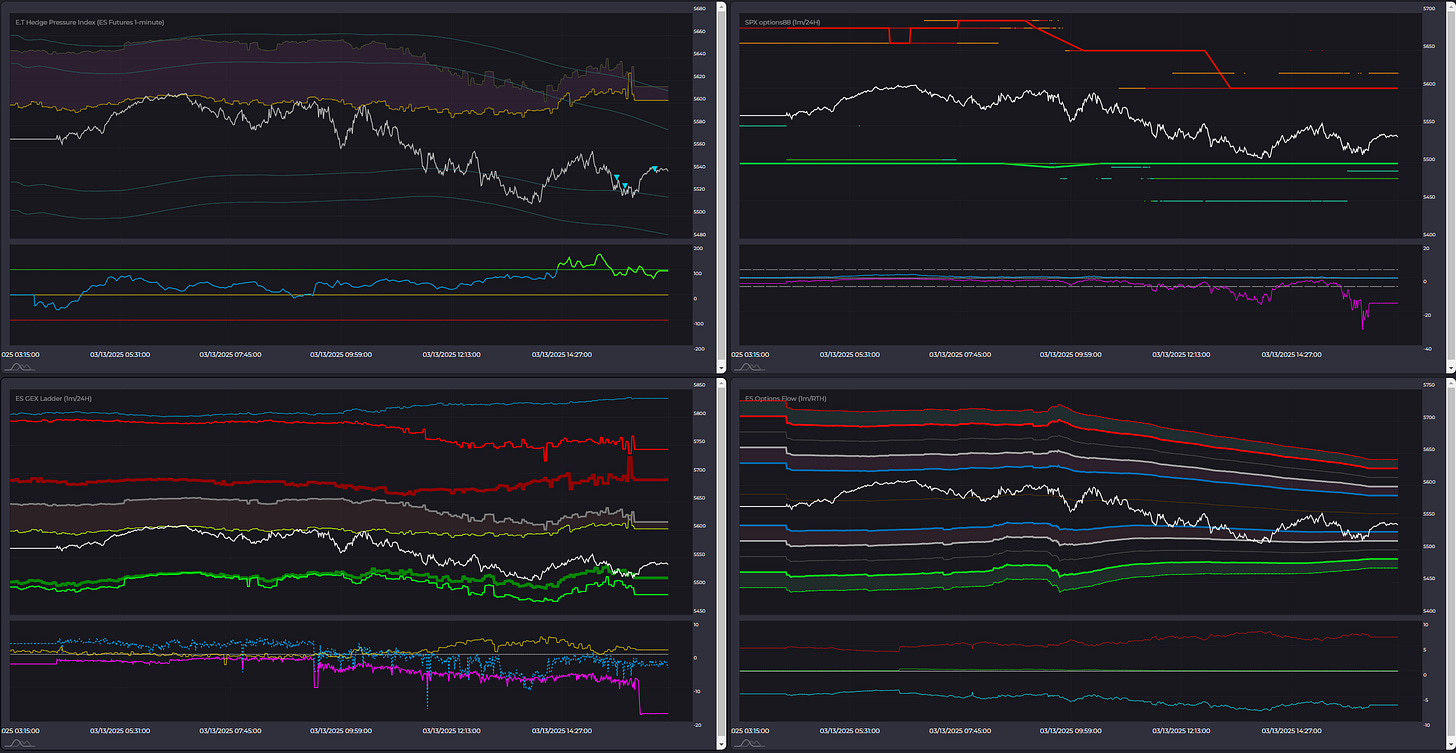

Key Options Levels (ES Futures):

TrendPhase (SPX):

Midterm Cumulative:

This section will undergo some redo, simplification.

//Midterm Metrics//

Macro/Positioning: 0

OptionsTrendPhase: 1

Auction/Orderflow: -1

Alerts: 1Intraday Orderflow Structure:

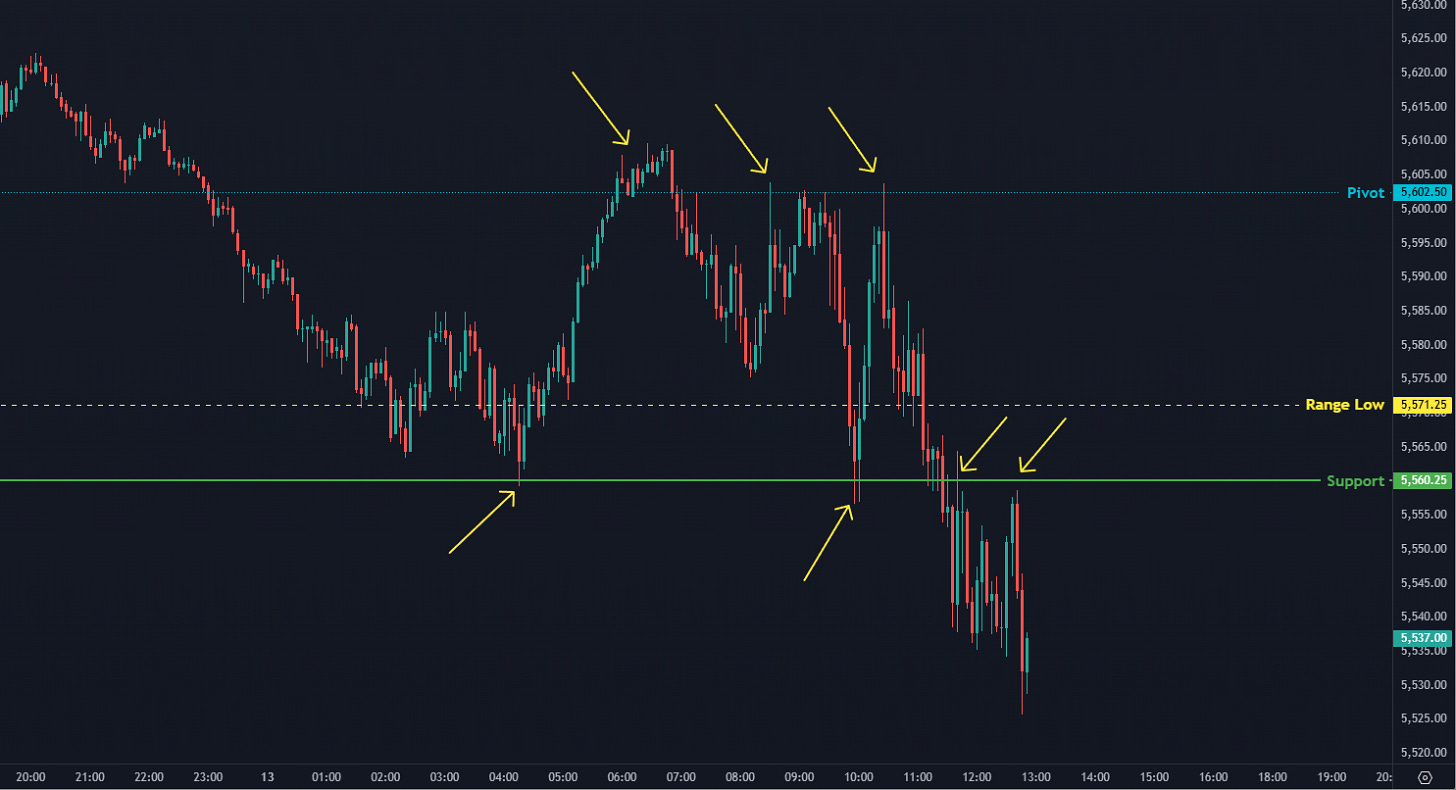

Key takeways:

I need to find a way to post orderflow structure after RTH session ends as many times some opportunities are already exploited when I post this commentary. The above one I posted on discord channel yesterday after close, so price already bounced of pivot multiple times.

As you can see this session is going to be different than yesterday. There is no Range and no Support line. Trading these is a bit more tricky as one needs to look at price action around these levels as these can be traded both ways today.

Notes:

Recap of yesterday’s HPI and other options metrics + Orderflow Structure.

Huge swings on HPI( c) bot, finishing day positive at the end.

Quite clear session and according to the plan from orderflow structire perspective. Bulls were active at support preventing bears from breaking out of the range. At the same time buyers tried multiple times to pass through Pivot which was critical to move higher. After third or fourth attempt bears attacked cleared support which now became resistance (some trapped longs - liquidity).