//Midterm Sentiment//

(days)

TrendPhase: Neutral (Feb 6)

Orderflow: Bullish (Feb 5)

------------------------------

(weeks)

Positioning: Neutral (Feb 3)

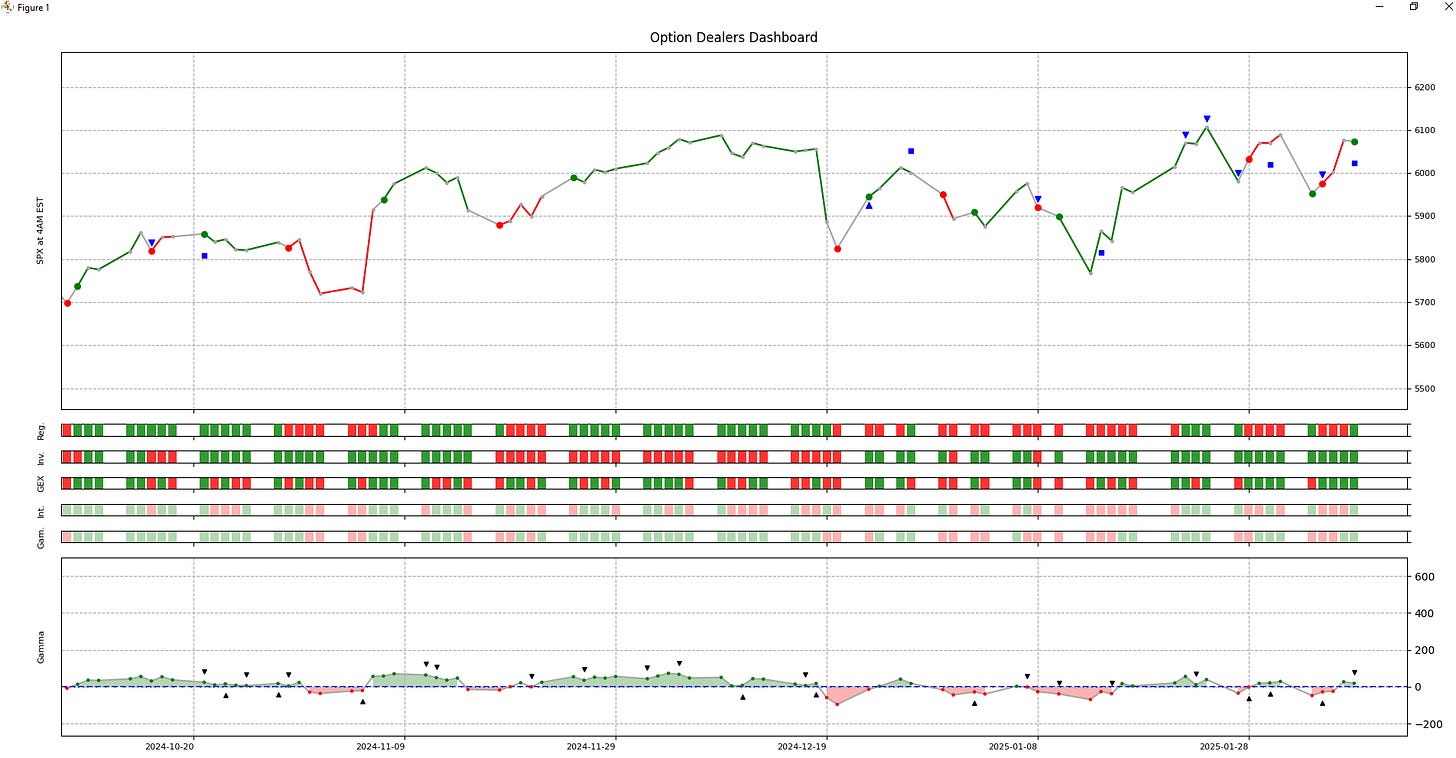

Dealers: Bullish (Feb 7)

------------------------------

(months)

Seasonality: Bearish (Jan 2)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral/Bullish

------------------------------

//Actionable Levels//

Resistance:

Pivot: 6087.75

Support:

Key takeways:

Not much happened on bearish window yesterday, today it seems there are supporting flows coming so adding long position to midterm strategy (right now 2 of max 7 positions are on, you can see it as grey numbers below/above midterm chart, also in total on the chart table).

Adding to long position as strategy total changed because of dealersdashboard bullish sequence start today.

Yesterday’s Intraday Trading Recap:

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).