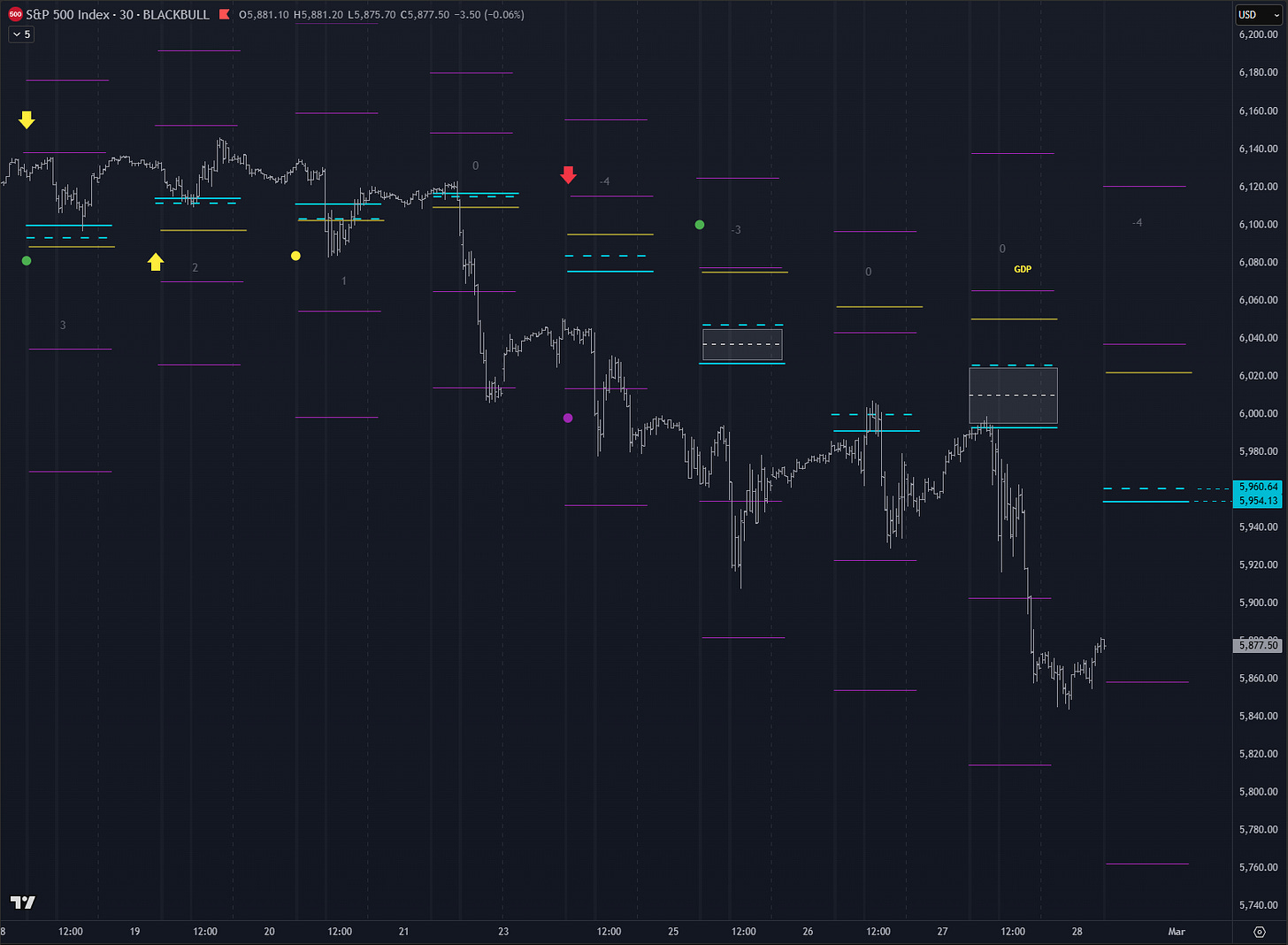

Structure + Gamma Levels:

Key Options Levels:

SPX TrendPhase:

Midterm Cumulative:

//Actionable Levels//

Resistance: 6040

Pivot: 5971.25

Support: 5760Key takeways:

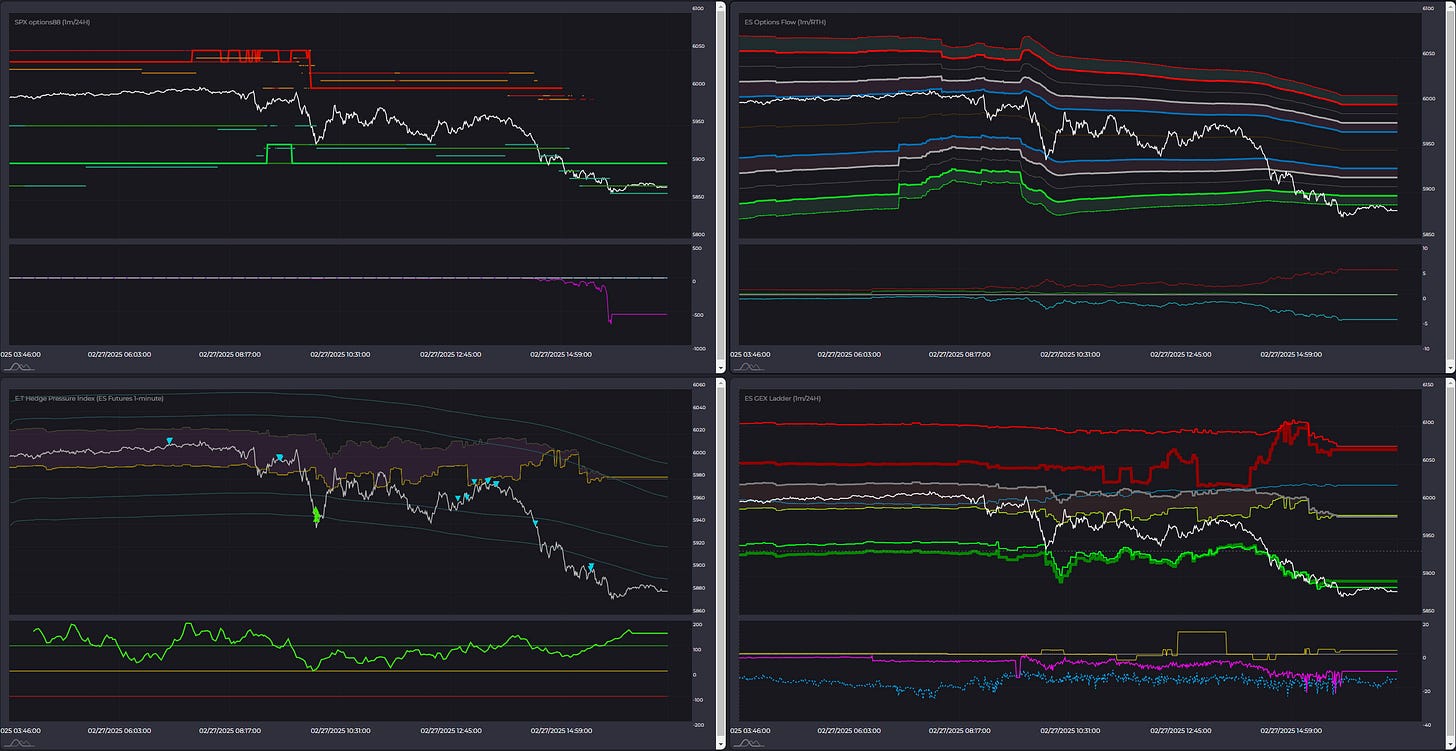

Lots going on. Flow signaling the market is close to bottom - at least in near term. I wrote a tweet about it.

Historically last few times this signal had been quite significant both at tops and bottoms:

There is quite a panic I think right now. Cem Karsan (@jam_croissant) has his view that we are about to get -10/-12% correction and then recession in couple months followed by QE. Wow, that is some prediction. And honestly as Im not following other people’s advice, this one got me thinking a bit. But I have to trust the process. Just giving you heads up that there are serious traders who have quite the contrary view to mine - and his view last few months were on point. At the end of the day we are pulling the trigger.

Orderflow looks terrible, but I guess it will most likely lag in these conditions. Which is not bad, you want price to be confirmed that market bottomed.

Where are big supports from VWAP? Well, major ones are 5700 area and 5300 as of now.

One more thing to mention is that eu session started with negative GEX, but it seems like it might change as their respective averages are getting closer and maybe it can flip at some point. Watch GEX Ladder for that or HPI chart.

Notes:

Yesterday’s HPI signals and other option metrics.

Same story as on other days with negative GEX. Also it is obvious to note, that exit long signals (blue down arrows) with negative GEX are great places to get short. I will work on this idea on weekend and update dashboard with respect to negative GEX.

Watch these blue dots (long exit signals) on last few sessions with negative GEX: