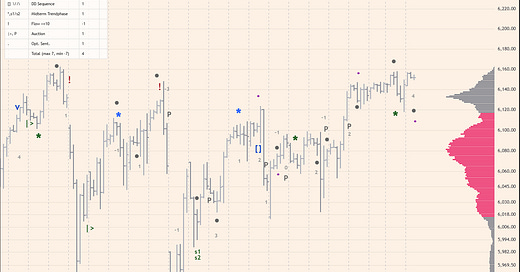

Structure + Gamma Levels:

Key Options Levels:

SPX TrendPhase:

Midterm Cumulative:

//Actionable Levels//

Resistance: 6169-76

Pivot: 6138.5

Support: 6089Key takeways:

First of all, made a small mistake yesterday, I have not noted midterm Trendphase trend change to bullish. But the overall score was unchanged either way as opt. sentiment was bearish.

But today on the other hand we have quite a change in our midterm scoring, as you can see it shows 4. So basically i’m adding to my long position. From midterm metrics it really looks solid now.

Also, there is a mildly bullish auction going on BTC, which given a correlation is also a bullish signal.

One thing I don’t like in this pretty picture is Hedge Pressure Index being very red as of now. But because this is intraday metric which can change on a dime I dont put too much attention to it in my midterm analysis. Just something to bear in mind for intraday plan, I will wait for HPI to turn green basically.

Notes:

Yesterday’s HPI signals and other option metrics: