//Midterm Sentiment//

(days)

TrendPhase: Neutral (Dec 26)

Orderflow: Neutral/Bullish (Dec 23)

------------------------------

(weeks)

Positioning: Neutral (Dec 20)

Dealers: Neutral (Oct 30)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral/Bearish

------------------------------

//Actionable Levels//

Resistance: 6096

Support: 6053Key takeways:

Still a bit more bearish arguments intraday so ladderbot already looking for short opportunities.

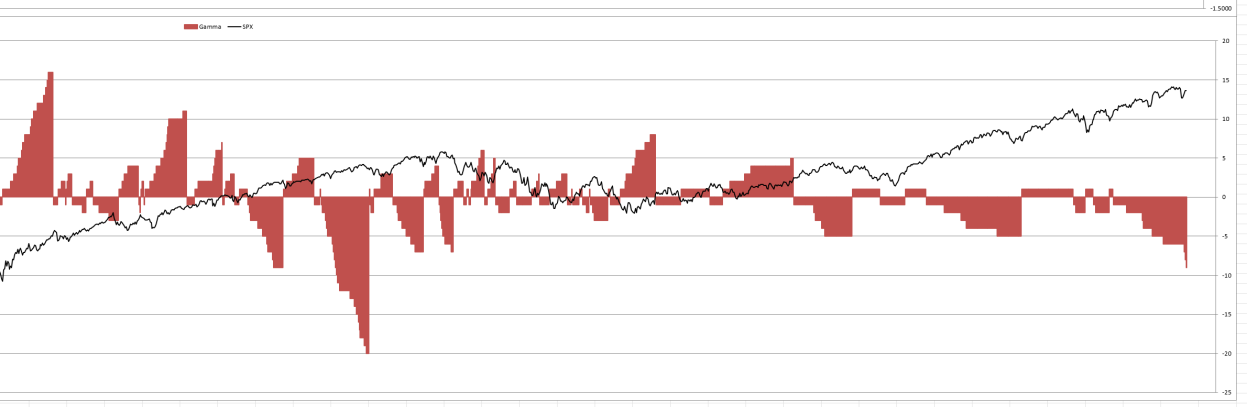

Midterm, looking at positioning based on options, we can see something large is building, probably for january/february which has these negative flows expected. It’s expressed by Gamma -9 now, which is not yet at historical minimum but very low nonetheless. There is usually a lag and the action itself comes when more things line up. In this case I am betting on January opex week. One thing that is concerning for sure, this January will be (and is) being front runned by the market as lots of participants anticipate some correction/decline.

Personally I want to see a confirmation in midterm orderflow to get involved heavier. I will close my small long position and take profit before year ends though.

Yesterday’s Intraday Trading Recap:

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).