//Midterm Sentiment//

(days)

TrendPhase: Bullish (Nov 26)

Orderflow: Neutral/Bearish (Dec 12)

------------------------------

(weeks)

Positioning: Neutral/Bearish (Nov 22)

Dealers: Neutral (Oct 30)

------------------------------

(months)

Seasonality: Bullish (Oct 1)

//Longterm//

(Years)

Great Cycle: Bullish (since March 2020) until 2027/2028Intraday TrendPhase: Neutral

------------------------------

//Actionable Levels//

Resistance: 6110

Support:Key takeways:

Closed all midterm long positions. Small midterm short initiated (1/8th).

Orderflow/profile shows bearish presence close to ath.

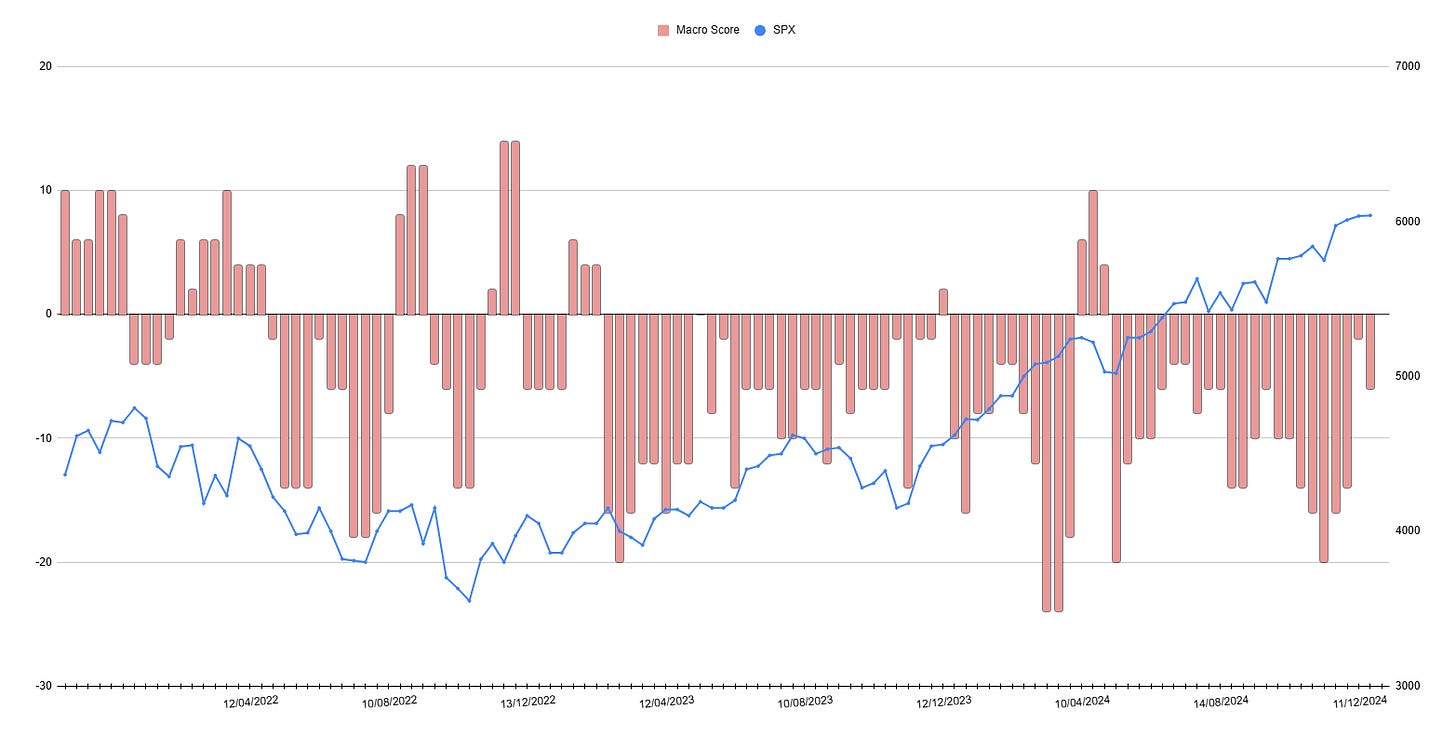

CPI changed fast macro to tick down making it bearish. Overall macro/posistioning turned -1 from 0 which is mild bearish signal.

Intraday flow/ladder looks neutral again - third day in a row which is very rare. So not convincing situation to trade intraday for me.

Yesterday’s Intraday Trading Recap:

Just one trade on bonds with nice overlapping bearish resistance probability.

Notes/Observations/Issues:

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).