Key takeways:

Trend-phase lagged quite a lot with bearish signal. Warnings from dealers dashboard ignored which was huge mistake (i’ll refer to it below). Also, price-volume structure was screaming bearish for few sessions, again ignored. I think I wanted to rely solely on trend-phase alone too much. I should know better, that no matter how good the tool is, it will not perform in the same way forever. And rather than focus on this one aproach it simply should be added to the set of tools which are already proven.

Anyway, what about today… well, metrics turned bearish. And obviously I will be looking for shorts. But a lot of signs out there points to rather oversold market - please, don’t take it as a hint to go long. For me it simply means to choose trade location wisely. Not jumping into short just because i missed terribly last two session’s action.

Reducing my long-term long position by 1/4.

Closing swing long position, initiating small short like 1/8 of normal size (such a bad timing, I know).

Resistance: 5140, 5150-65

Support: 5056-48

Notes/Observations/Issues:

One of the signs, market is a bit over-extended. Bearish resistance levels overlap SR1/SR2 GEX levels. This, on the other hand makes a huge resistance zone for today.

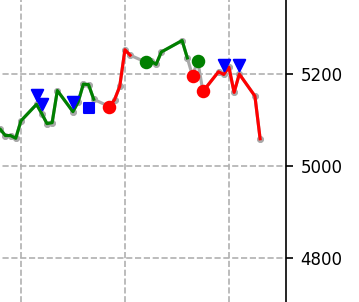

Ignoring this was such a bad idea. Two short signals (short because triangles pointing down came while SPX sentiment was red/bearish). Now, it’s important to note that tomorrow, most likely, we will have a square which means, reduce or close short (depending on strategy).

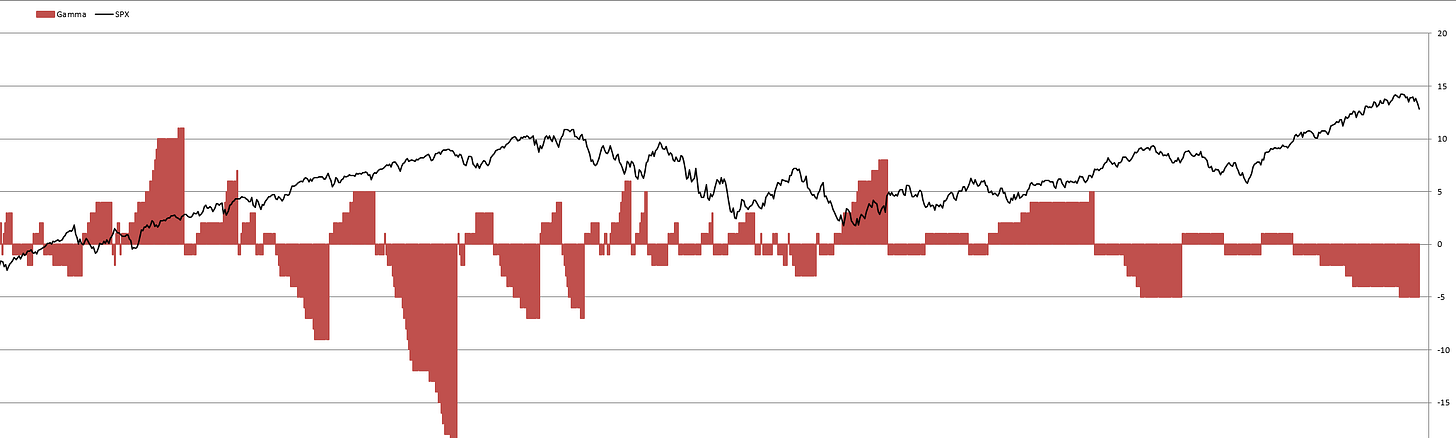

Gamma -5/+5 signal, this one I actually had in the back of my mind as historically I know that it’s just a matter of days for the price to react, but yea, ignored this time.

$BTC, although there is selling pressure from the last important bearish value which I marked few days ago, price seems to be stuck between these two fractal levels. Breaking 62500 would defienietly help further decline.

Pre-Open Commentary distills key takeaways from the analysis of the London GEX and Structure posts and also serves as my personal journal (sort of).