SPX Gamma Profile Trend Phase:

Midterm Trend: Bullish

Intraday opportunities: Neutral

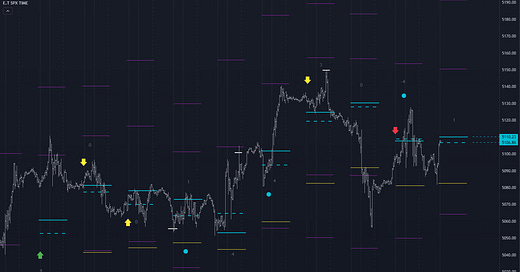

London GEX + Gamma Profile (ES Futures):

Major levels chosen from London GEX and Gamma Profile.

(complete sets of major and minor levels on charts below)

Notes:

The Midterm (or core) Trend can be classified as either Bullish or Bearish and is determined by analyzing all key options metrics. It is established at a specific moment when all indicators align in the same direction. Although it may experience a lag of 1-2 sessions, it aims to maintain position in a swing trade for an extended period.

Intraday Opportunities can exhibit a Bullish, Bearish, or Neutral stance. They are identified through a series of setups, which are based on various combinations of sentiment metrics, Trend Phase and markers of overnight bias. These opportunities are flagged based on their historical effectiveness, which must be at least 75% to indicate a bullish or bearish bias for the trading session. A Neutral indication means that the probability for a specific setup falls below the 75% threshold.

The Midterm Trend should not influence intraday decisions. However, when opposite signals occur—for instance, a Bullish Midterm and a Bearish Intraday signal—it can be prudent to adjust your strategy by reducing the size of your swing position. This approach helps in managing risk and aligning your trading strategy with the prevailing market conditions.

(to be continued)

Hey,

how should I play these levels? As an example, on the left chart we have 5 resistances (are all of them important?):

1. 5137 - :Max - should we play short here?

2. 5155 - :Max1/2 - should we play short here?

3. 5160.50 - Overbought (is it resistance or just info that we are in some overbough region or is it resitance level that should have some reaction? i.e. is it worth to play short here?)

4. 5167.50 - Normal Range (is it resistance or just info that we are in some overbough region or is it resitance level that should have some reaction? i.e. is it worth to play short here?)

5. 5174.50 - Flush - I noticed sometimes it gives good reaction, so should be played short here, right?

On the right chart we have 2 resistance levels:

1. 5155 - Resistance 1

2. 5172.41 - Resistance 2

Should we play short on both levels? What's best SL? 5 pips, 10 pips?

To sum up, I see 7 potential short level here on 37 pts range approx (5137 -> 5174). Should I try to play short on each of these levels? Personally I feel like there's too much resistance points and i am getting a bit lost trying to understand these