If you don’t know what the HPI study is, then go ahead and check out this video:

Below, you will find HPI performance dashboard for each day since I launched the study. So far we are two weeks into forward tests.

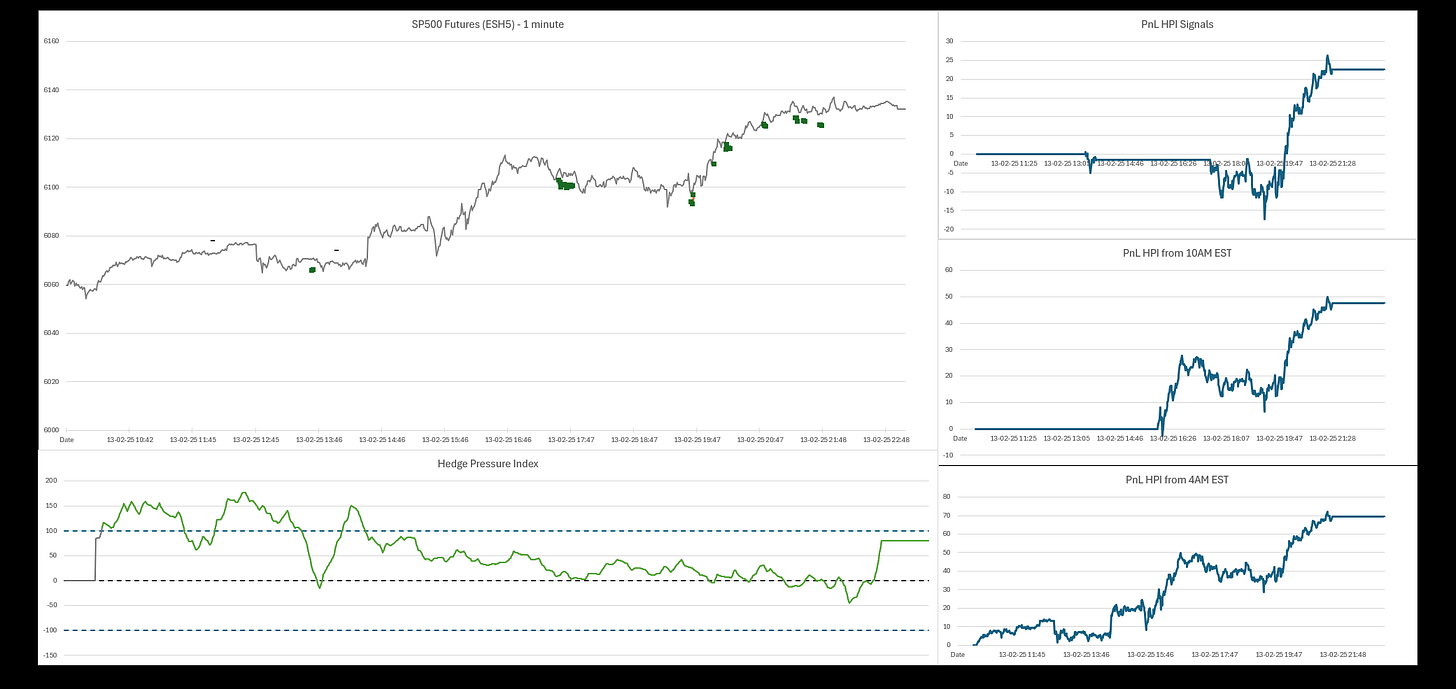

For now I am testing three different strategies, as far as mechanical signals go. So, on the left side you can see ES price plot with signals (red/green squares and small black lines as exit signals - below ES plot short exits, above ES plot long exits).

On the lower panel we have HPI study itself. It is colored green for bullish pressure and red for bearish pressure.

On the right side we have three panels with automatic strategies being tested. These show single session, minute by minute history of PnL expressed in ES points.

PnL HPI Signals - this one basically follows red/green squares on ES chart with exits at small black horizontal lines. There is also max daily loss of 25 points which turns strategy off.

PnL HPI from 10AM EST - this strategy trades according to HPI study color but limits the exposure time. It trades from 10AM EST until 15:30EST. At this moment this one seems to have the least drawdown and best risk/reward ratio. It looks like 25-30 points hard SL is reasonable for that strategy as a “kill switch” for the day.

PnL HPI from 4AM EST - same as above but trades from about 4AM EST, so basically just after London open. This one seems to make highest number of points but for the price of larger drawdown during single session. On the other hand, if we apply a “kill switch” of about 30 points it also looks like a great performer so far.

Few general notes:

- nothing works 100%, even if this estimates, rather well, dealers impact on the market, there are other flows which can affect price, sometimes in much heavier way.

- still need more data, more sessions to analyse, but we’ll gather it in time.

- strategies for now are pretty raw and simplistic, I don’t want users to get impression that this is definietly the only way to use HPI.

If you are already a HPI user:

- I will be sending invitations to HPI discord today and tomorrow.

- next in line are two bots based on HPI which you are going to get access to. Most likely this week.

If you are interested in subscribing to Hedge Pressure Index then head to my webiste: