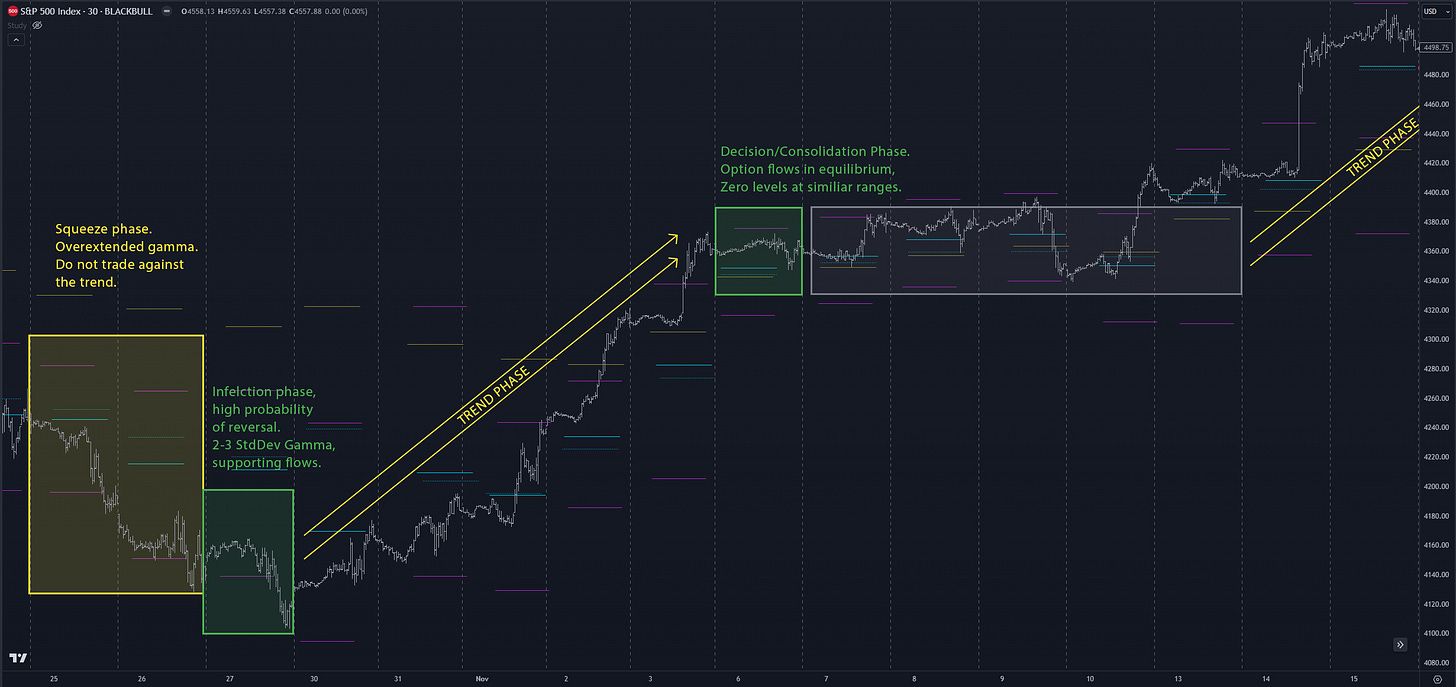

Gamma Profile Trend Phases added to pre - market analysis.

New feature based on current research of Gamma Profile.

As with most research I undertake, everything usually begins with the intuition that it's worthwhile to devote more attention to something. This intuition is very important because in some strange way, it gives us the ability to choose data for study which, despite not knowing yet if they make sense, seem worth exploring.

In the case of Gamma Profile, the collection and analysis of data took quite a long time. Before I noticed certain recurring mechanisms, I used levels only as supports and resistances. But somewhere deep down, I knew there was a broader context, a greater potential in this.

So, starting from Monday, the pre-session analysis of London GEX will be supplemented with a report on the current situation in the Gamma Profile Trend Phase. It appears that changes in the relations between option levels such as Zero Gamma, Max Gamma, or Min Gamma definitely occur in specific configurations at market peaks, troughs, and consolidations. At the same time, the after-session post will be available for free to everyone.

Whether Trend Phases are a reliable analysis that can be used in trading (after a relatively short testing period) is to be discovered. Of course, as with most experimental analyses that I present, especially here on Substack, I approach this cautiously. And what does this mean in practice? It means that I allocate a small amount of money for CFDs under this strategy and check it in a forward test. And here we close each research phase with a bracket, namely intuition, which after years of practice will suggest whether to increase or perhaps cut back on a certain type of analysis.

Starting today, whether you purchase substack subscription or Emini.Today terminal subscription you will get the other one for free.

Also, I will be rolling out “Black Week” sale tomorrow which will enable you to buy yearly subscription to Emini.Today + Bubble Machine with 80% discount.