In response to numerous inquiries about my Bitcoin analysis shared on Twitter and Substack, I've compiled all the elements that contribute to this work. If you're aiming to learn or refine your skills trading Bitcoin, this could be for you.

Big Picture

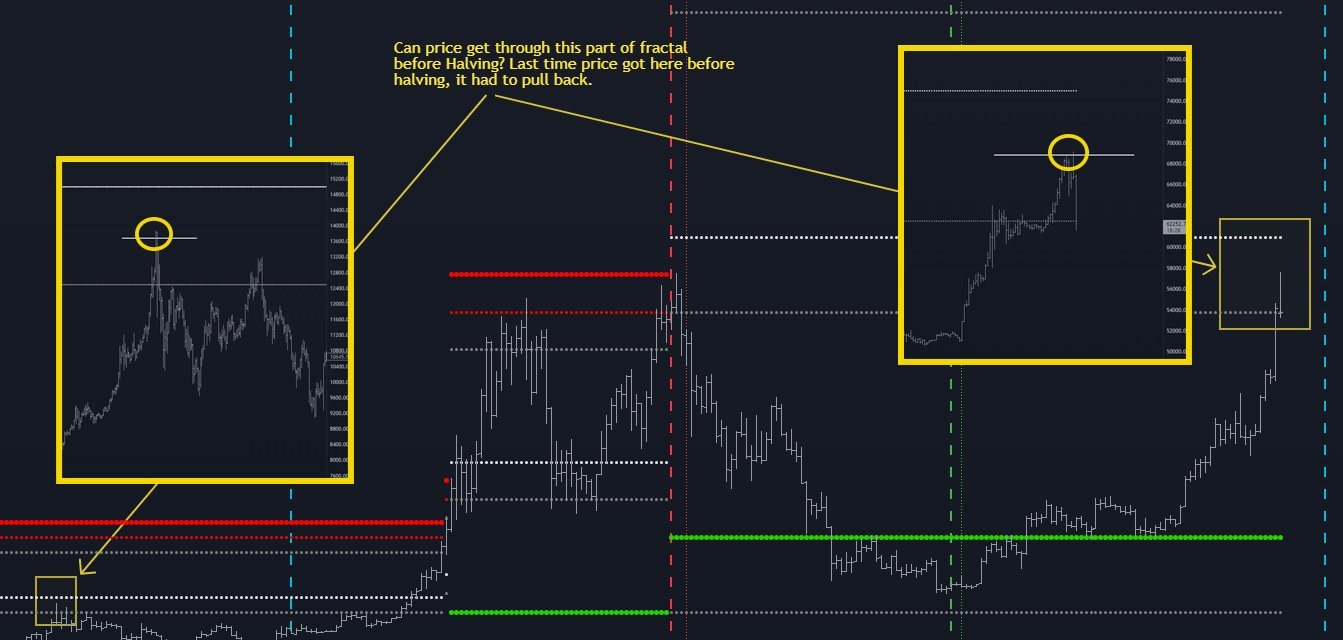

Bitcoin cyclicality explained

A common "bug" in Halving Cycle and how to fix it

Price cyclicality based on proprietary fractal math

In this section, we will explore a broader perspective on Bitcoin's cyclicality in terms of both price and time. We will utilize an improved time cycle in conjunction with the price cycle, which seems to be the foundation upon which we can interpret Bitcoin's behavior over the past years and the years to come.

The tools included in this section are yours to keep forever, consisting of a spreadsheet, a time cycle indicator, and a Bitcoin-specific price fractal for TradingView.

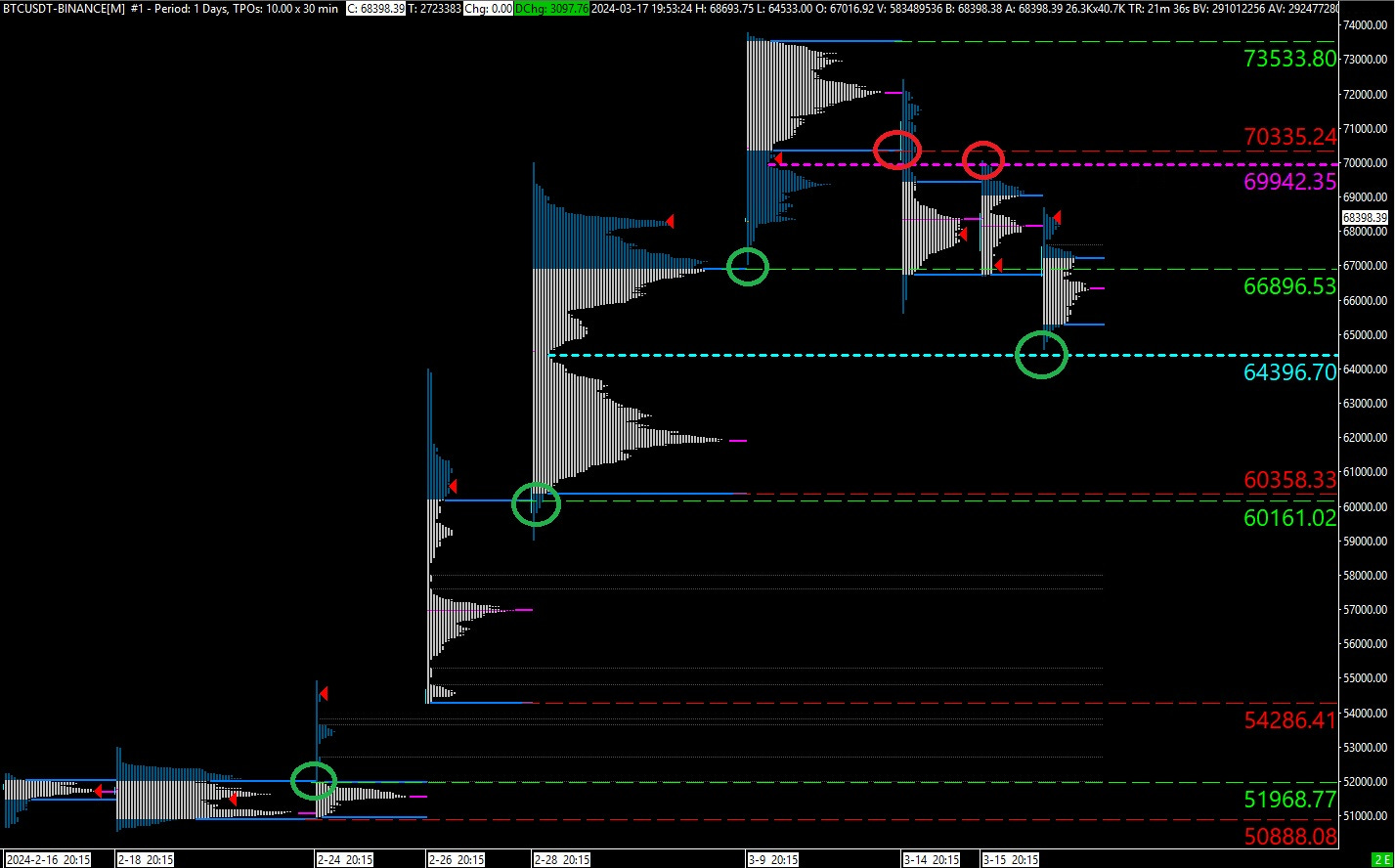

BTC-specific Orderflow Analysis for Short-Term Trading

Correct profiling of BTC supply-demand with orderflow tools

Identifying short-term imbalances to locate trapped buyers and sellers

Searching for "strong hands" in orderflow

Bitcoin is often considered a purely technical market. This perspective makes sense due to its minimal correlation with fundamental data.

The main factor influencing short-term crypto price behavior is pure supply and demand. In this segment, we will delve into techniques specifically optimized for the BTC market.

The tools you will receive for permanent use include chartbooks for Sierra Chart. Additionally, for those users who solely utilize TradingView, I will provide a setup for profiling on that platform.