Bond's/Fractal Sequence inflection point.

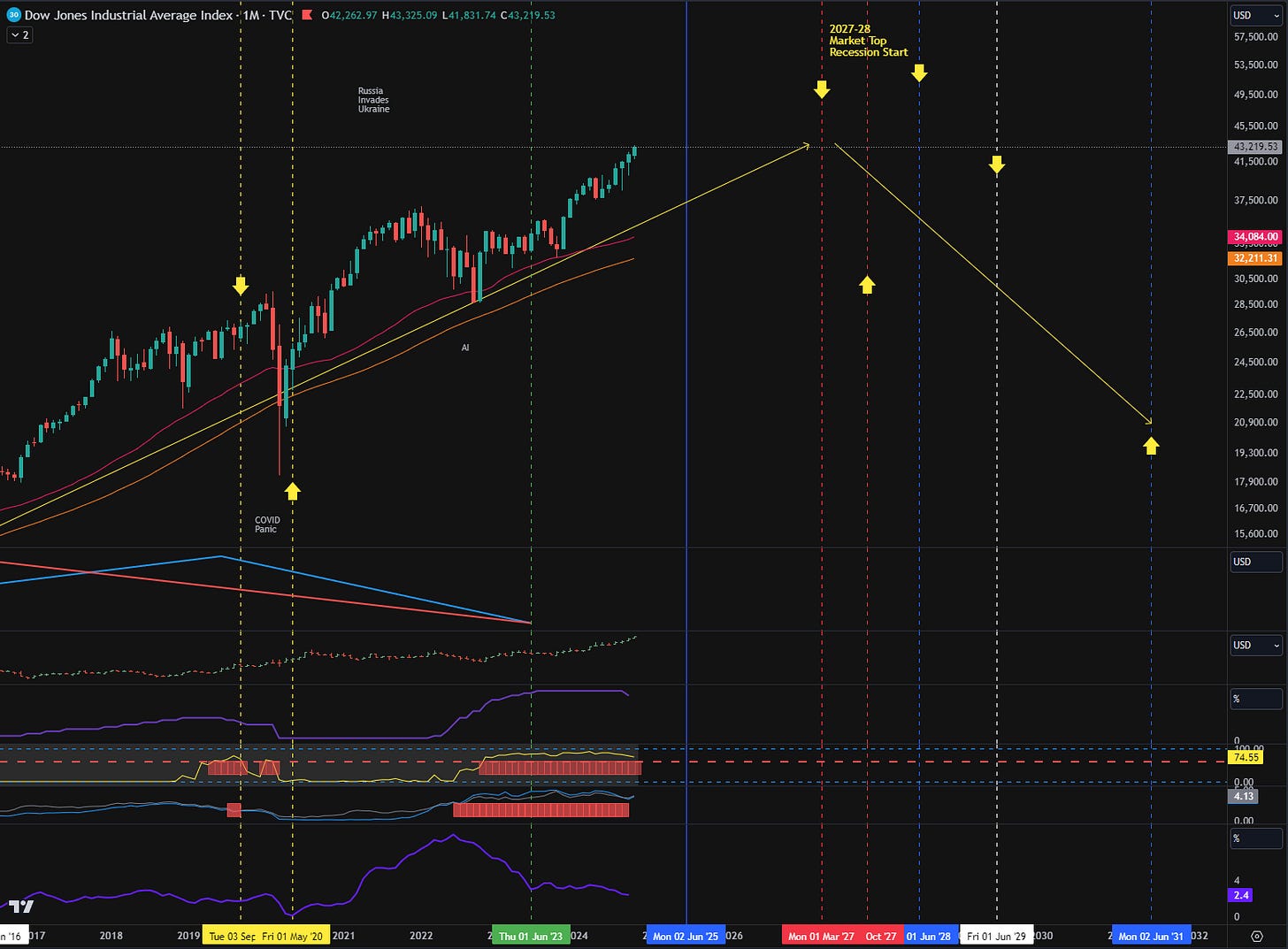

DJI is getting close to critical price area during bond yields inversion period.

First of all, if you haven’t already seen it, the context of this post is the video I recorded 2 years ago.

In short, I explained there, why I think market will most likely go much higher and pointed out the area from which equities will start to slide significantly.

It so happens that DJI did just that, and it took about 2 years for price to reach these levels.

So is this it? Are we facing some major decline, maybe a correction or something even worse? Well, looking at few decades long history of this macro/technical setup, it seems that this might be it. I mean, “signal” itself is there, no doubt.

But, I am hesitant and here is why and what I am personally going to do about it. First of all, back then when I was doing this analysis, I was missing a very important piece of information. I think I was already working on it but it was still in the making. I am talking about The American Cycle which those subscribing to Wealth Cycle know very well.

That cycle works since the very beginning of US stock market. Historically it points out every secular bull and bear period. Consistently for over 120 years. And this is also the main driver for my longterm operation on SPX. Bullish until 2027-28 which marks the beginning of secular bear market from the cycle perspective. So that means, the cycle is still bullish and it will remain so for about 2-3 years more.

Obviously this is a longterm view and ofcourse there have to be some volatility incidents during such a long period of time, but core longterm position is still bullish without a doubt.

On the other hand, I can not simply disregard bond/fractal situation. That would not be wise in face of its historical results. Consistent results. Ok, so how to aproach this or rather how will I handle this situation?

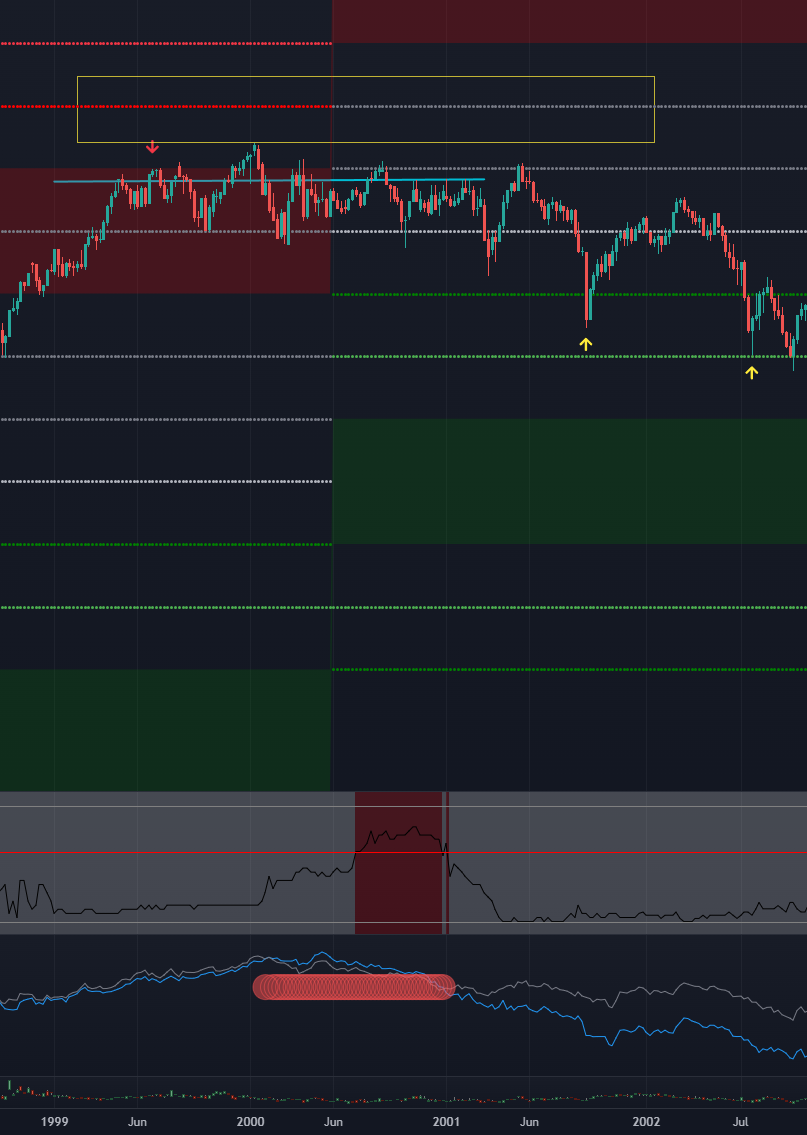

First of all let’s look at bond/fractal situations in the past because I want to make a point here:

As you can see, even though Dow reached bearish fractal area, in these two periods, there wasn’t like immediate reaction. It took months of sideway action until market finally broke down significantly. Mind you, that sideway action was built by rather volatile moves up and down 5-10% range!

But what if one of these two frameworks (American Cycle or Bond/Fractal Sequence) is actually wrong and it’s no going to work this time around? That is a good question and kind of like a bet really. But are there any odds/probabilities we could assume here? I definietly think yes. I mean, if I would have to bet on one of these frameworks, I would definietly go with American Cycle because the reason behind it is not only working consistently through time but it is so much more un-esoteric than fractal component in bond/fractal sequence framework.

Don’t get me wrong, fractal math is great, bond yield curves are useful things - but this is not the cause of market trends in the long run compared to what constitutes the cycle. Obviously I’m not going to get into details of the American Cycle now, but if you are interested in understanding one of the greatest research I have made, and understand what is really driving the market, then just go ahead and see for yourself.

My plan.

So… where we are at? The Cycle is still up, like I said, until 2027-28 and I do not want to close my bullish long term position just yet. But I also do not want to completely ignore a really consistent “signal” in this timeframe. So what I will do is get rid of 1/8 of my longterm position. But that is not all. I will actively manage 1/4 of what’s left in this position, using midterm framework. So basically I will close 1/4 when I get solid midterm swing signal short. And same I will add it back when I get solid midterm long signal. Simple as that.

Obviously this is up to you. At the end of the day it’s a bet. Maybe the short bond/fractal signal fits better to your framework which might already be bearish for other reasons. If so, then definietly it can be some kind of reinforcement to your thesis.

For me, it’s just too early, so even with some bumps coming up (like 5-10% pullback ;) I would still treat is as an opportunity to add. But then again, I started to build my longterm bull position well over a year ago, so hard to compare for example with someone who wants to start a position or is already in but since month ago… That I obviously leave up to you.

cheers.