Automated Trading for Ninjatrader

Introducing algo strategy project optimized for Ninjatrader/Prop daytrading Accounts.

Introduction.

After completing the coding of Sierrachart/Ninjatrader indicators for options data analysis, and especially after gaining confidence in coding for NinjaTrader, I concluded that the natural next step would be to automate the strategy based on these indicators.

The Pre-Market Commentary, which you can read daily on Substack, is actually based on a series of mechanical rules that might initially seem partly discretionary. However, in reality, they are dictated by a pattern of specific interpretations of individual metrics, which I publish in the Structure and London GEX posts.

Upon adopting a specific, mechanical strategy and testing it on available data, it seems that eliminating the human factor (usually the weakest link in trading) would be a sensible step and an experiment to which I would like to invite a small group of people. Together, we can not only test it in real conditions but also refine any potential shortcomings of the strategy.

Therefore, today I am opening the opportunity to join this experiment, hoping that it will prove to be a useful tool and perhaps a step towards broader automation based on the tools we currently use. The limitation on the number of users - I estimate at this moment to be the first 11 people who apply - is for obvious reasons. I believe that every strategy, especially intraday, has its "capacity" if speculation occurs at the same time and price. Secondly, since I still treat this as an experiment, people who join must be aware that this is a first step, which may require further work and refinement at a later stage.

Ninjatrader Prop Accounts friendly.

The software is created for the NinjaTrader platform. From my observations and market research of prop trading firms, it seems to be the most commonly chosen platform. From my perspective, it doesn't matter much, but I also have to admit that creating automations for this software is quite well organized. Another important matter is that I want to start the experiment on the accounts of a prop trading firm. This is associated with low financial requirements, and thus a small initial risk. Since such companies have clear requirements and guidelines regarding risk, such as dynamic drawdown, daily drawdown, maximum lot size, etc., our strategy will be optimized specifically for these types of requirements.

Of course, this does not exclude individuals who have their own private accounts and use the NinjaTrader platform for trading from being able to use this strategy. It's clear that this can be done, however, I personally want to conduct this initially through a prop trading firm, in my case, Apex - I have no affiliate agreement with them, so there will be no referral links or anything similar. Everyone is free to choose whichever firm they prefer. As long as they use NinjaTrader.

Strategy Characteristics.

The strategy's concept primarily relies on what I consider to be the strongest aspect of the metrics we use, mainly based on the analysis of the options market. Namely, determining the probability of the direction in a given session, followed by the timing and price at which we want to execute a transaction. All the transactions must be closed before market closes for the day - which is what most prop-firms require.

Although it may seem too cautious for many, I personally believe that the key factor determining the success of a strategy is identifying real opportunities. And what is such an opportunity? Primarily, such opportunities do not occur all the time. The edge we will be using is not something that accompanies us at all times. Moreover, most sessions will simply involve waiting and doing nothing. Algo only takes action when we have a clear statistical advantage. Therefore, the strategy is not a scalper; it does not execute dozens or hundreds of transactions a day. The strategy patiently waits until the metrics on which it is based provide a clear buy or sell signal.

And despite its high effectiveness, it always limits risk with an appropriately placed stop loss. An additional essential element is also selecting the right size for the transaction. All these elements will be built into the algorithm, which is meant to be 100% hands-off. So, initial size, predefined risk, entries, and exits.

Stats and Results.

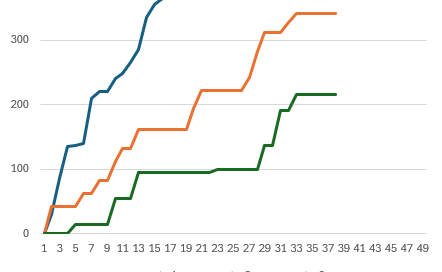

Below, you can review the results of the discussed strategy over the last six months or so - since the collection of the complete set of option data needed to generate a signal began. The results in $ are provided for the APEX account where the maximum allowed drawdown (dynamic so from equity high) is $2500. In other words, the strategy entered with batches of 5 MES contracts. In the example below, we have monitored 3 types of entries, which differ in frequency and the size of the stop loss. The user will be able to choose whether they want to use all three or perhaps just one or two of them.

Technicals.

Access for the first 11 people will be opened today. It's first come, first served. Then, within the next few days, I will create a separate Discord channel for communication. Finally, by mid-April at the latest, I will release the software so everyone can start testing at roughly the same time.

The license fee covers a minimum period of 3 months but can be extended (for free) if it turns out that the bot has not generated the desired profit during this time and further development work is needed. In such a case, access will be automatically extended. Priority for license extension will, of course, be given to those who were in the first group of initial users.

Substack Access.

All bot users will have guaranteed full access to my Substack and daily analyses for the duration of the license.

Hello, is the experiment still goin on? If so, I would like to join in.